Sports Medicine Devices Market Size, Share, Growth & Industry Analysis, By Product (Braces & Supports, Arthroscopy Devices, Regenerative Medicine, Monitoring & Testing Devices), By Application (Injury Prevention, Rehabilitation, Performance Enhancement), By End-User (Hospitals, Clinics, Sports Academies, Home Care), and Regional Analysis, 2024-2031

Sports Medicine Devices Market: Global Share and Growth Trajectory

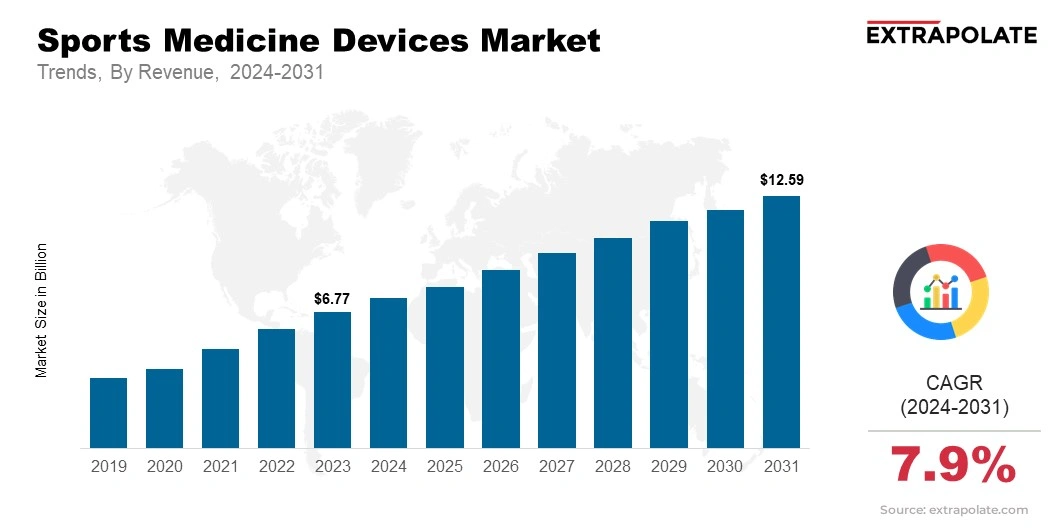

The global Sports Medicine Devices Market size was valued at USD 6.77 billion in 2023 and is projected to grow from USD 7.37 billion in 2024 to USD 12.59 billion by 2031, exhibiting a CAGR of 7.9% during the forecast period.

The global market is recording steady advancement, guided by the expanding knowledge about the significance of being physically fit, innovation in sports medicine technology, and expanding need to prevent injuries and ensuring recovery.

This market covers a diverse selection of devices, which includes orthopedic supports, joint braces, thermal therapy devices, and muscle stimulators. As athletes, fitness enthusiasts, and healthcare specialists seek more practical solutions for preventing, treating, and managing sports-related injuries, the demand for advanced sports medicine devices is on the rise.

Revolutionary developments in sports medicine devices have facilitated better medical solutions, quicker recovery times, and enhanced results for athletes. Developments such as smart wearable devices for tracking movement and exercise, muscle strain, and recovery progress are experiencing increased adoption.

These devices not only improve performance but also help in injury prevention by enabling real-time monitoring, allowing people to make empowered choices for their physical fitness.

The market is also reaping benefits from the growing participation in sports and relaxation activities all over the world. This growth is specifically visible in developing markets, where the increasing disposable incomes and increased accessibility to sports facilities are propelling the demand for sports medicine solutions.

Additionally, the increasing older population, which remains active in sports and physical activities, is also facilitating business expansion, as the older population look for devices to protect against and cope with aging-related injuries.

Regarding regional expansion, North America remains at the forefront of the market, essentially due to increased awareness about sports medicine and the integration of state-of-the-art medical technologies.

Europe and Asia-Pacific are also experiencing substantial market expansion, with Asia-Pacific showing a hike in demand due to surging financial support in sports infrastructure and improvements in healthcare.

The market is composed for persistent expansion as technology makes progress, customer knowledge expands, and the worldwide focus on physical health progressively rises.

With continuous improvements in equipment performance and performance, the market for sports medicine devices is ready to flourish, providing athletes and health-conscious individuals with enhanced tools for preventing injuries, accelerating recovery, and ensuring integral well-being.

Key Market Trends Driving Product Adoption

Various key trends driving the adoption of sports medicine devices are:

- Advancements in Technology: Cutting-edge advancements in sports medicine devices, such as innovation in wearable devices, artificial intelligence, and smart materials, are improving product functionality. These developments enable advanced injury prevention, rapid healing, and optimized performance assessment.

- Increased Focus on Physical Fitness and Wellness: The increasing consciousness about physical fitness and wellness, integrated with a growth in the number of people engaging in sports and relaxation activities, is influencing the demand for sports medicine devices to facilitate in prevention of injuries and rehabilitation.

- Growing Demand for Minimally Invasive Solutions: The increasing preference for minimally invasive treatment methods, such as arthroscopy and regenerative medicine, is driving the demand for sports medicine devices. These methods shorten the healing process, reduce scarring, and boost cumulative patient progress.

- Integration of Wearable Technology: Wearable devices, such as fitness trackers and smart clothing, are becoming essential for sports medicine. These devices examine an athlete's performance and provide important information that can help prevent injuries and facilitate healing.

- Increased Adoption of Regenerative Medicine: Regenerative medicine, which comprises treatments like stem cell therapy and platelet-rich plasma (PRP) therapy, is becoming more widespread in sports medicine. This trend is propelling the development of innovative tools that enhance these treatments

Major Players and their Competitive Positioning

The market is intensely competitive, with various key players fueling advancements and innovations in this sector. Prominent companies in the market include Zimmer Biomet, Stryker Corporation, Smith & Nephew, Arthrex, and DJO Global. These companies are making major investments in research and development to create more efficient, long-lasting, and advanced technological solutions.

Partnerships, acquisitions, and collaboration are common approaches used by market leaders to strengthen their market position and improve their technological contributions.

Consumer Behavior Analysis

Consumers of sports medicine devices include both trained sports professionals and casual participants who actively participate in leisure or physical activities. Key elements determining the behavior of consumers in the sports medicine devices market are:

- Injury Prevention: Several consumers buy sports medicine devices for injury prevention, especially in sports with high level of risks such as football, soccer, and basketball. These devices can help lower the chance of injuries by providing support, enhancing adaptability, and improving recovery after exertion.

- Recovery and Rehabilitation: Athletes and fitness fanatics progressively use sports medicine devices during recovery to accelerate rehabilitation. Devices like braces, supports, and rehabilitation equipment enhance speed and effectiveness of recovery.

- Performance Enhancement: Sports medicine devices are being used progressively to boost athletic performance by facilitating joint and muscle protection, enhancing flexibility, and mitigating overuse injuries.

- Technology Integration: The integration of smart technology, like wearable fitness trackers and smart knee braces, is persuading consumer’s action. Several consumers opt for devices that provide live data and analytics to study their health and performance.

Pricing Trends

Pricing in the sports medicine devices market is impacted by a range of factors, which include the type of device, the technology that is used, and the brand. Essential products, such as braces and supports, are reasonably priced, while progressive products, like regenerative medicine devices and wearable technology, are ranked at a premium.

The growing availability of cutting-edge features and innovations is leading to varied price points in the market. As competition intensifies and technology progresses, prices for specific products, like wearable devices, are anticipated to decline, making these devices more easy to access for a wider audience.

Growth Factors

Factors fuelling the growth of the sports medicine devices market:

- Increase in Sports Injuries: The growth in the number of sports-related injuries, especially between athletes and fitness fanatics, is propelling market growth for sports medicine devices for both avoiding injuries and recovery.

- Technological Advancements: Technological advancements in sports medicine devices, such as smart wearables, have set a new standard in the industry by allowing instant data acquisition, performance evaluation, and injury mitigation.

- Aging Population: With the rise in the elderly population worldwide, there is a rise in demand for tools that enhance joint function and flexibility. The aging population, specifically those who take part in leisure sports, is helping to increase the demand for sports medicine devices.

- Rise in Physical Activity: As individuals are getting aware about the benefits of physical activities, more people are getting involved in sports and recreational activities, which is leading to an increased demand for sports medicine products.

- Growth of the Regenerative Medicine Market: The growing use of regenerative medicine techniques, like stem cell therapy and PRP, is propelling the need for tailored sports medicine devices designed for supporting these treatments.

Regulatory Landscape

The regulatory landscape for sports medicine devices is controlled by rigid standards which are set by regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These rules guarantee the reliability and efficiency of sports medicine devices.

Regulatory validation for the latest devices, mainly those that employ high-tech solutions or regenerative medicine, can be a time-consuming process but is necessary for maintaining product standards and safety

Recent Developments

Recent developments in the market:

- Advancements in Wearable Devices: The innovation of wearable sports medicine devices that track live data, like heart rate, muscle activity, and joint health, is revolutionizing the industry. These devices help in preventing injuries and optimize performance.

- Growth in Regenerative Medicine: Regenerative medicine techniques, such as stem cell therapy and PRP, are becoming more widespread in sports medicine, accelerating the adoption of specialized technology that supports these treatments.

- Collaborations and Partnerships: Companies in the market are building collaborations with technology firms to incorporate smart technologies into their products. These collaborations are resulting in the advancement of next-generation devices that provide advanced features and tracking performance.

Current and Potential Growth Implications

a. Demand-Supply Analysis: The demand for sports medicine devices is poised for ongoing expansion, especially in the areas of injury prevention, rehabilitation, and optimization of performance. The supply of modernized, smart devices is also anticipated to grow as companies are focusing on research and development to meet the increasing demand for smart sports medicine products. Conversely, the market may face difficulties related to regulatory approval processes and the cost of cutting-edge technologies.

b. Gap Analysis: There is a remarkable gap in the availability of cost-effective, premium sports medicine equipment in developing regions. Companies that can resolve this gap by offering affordable solutions can hold a greater portion of this market, which is observing a growth in the number of people taking part in sports and physical activities.

Top Companies in the Sports Medicine Devices Market

- Zimmer Biomet

- Stryker Corporation

- Smith & Nephew

- Arthrex

- DJO Global

- ConMed

- Medtronic

- Össur

- Breg, Inc.

- AlloSource

Sports Medicine Devices Market: Report Snapshot

Segmentation | Details |

By Product | Braces & Supports, Arthroscopy Devices, Regenerative Medicine, Monitoring & Testing Devices |

By Application | Injury Prevention, Rehabilitation, Performance Enhancement |

By End-User | Hospitals, Clinics, Sports Academies, Home Care |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The subsequent segments are expected to experience substantial growth:

- Regenerative Medicine Devices: The demand for devices supporting regenerative medicine, like stem cell therapy and PRP, is rapidly increasing as these treatments are gaining popularity in sports medicine.

- Wearable Devices: The progressive use of wearable technology for preventing injuries and performance optimization is expected to drive a drastic increase in this segment.

Major Innovations

Innovations in the market:

- Integration with Wearable Technology: Companies are incorporating wearable technology into sports medicine devices to allow the collection of live data and observe performance and recovery.

- Advancements in Regenerative Medicine: The latest devices made for supporting regenerative medicine techniques, such as PRP and stem cell therapy, are being used to accelerate healing.

Potential Growth Opportunities

Various growth opportunities that exist in the market are:

- Emerging Markets: With the increasing engagement in physical activities in developing regions, there is an increase in demand for budget-friendly, efficient sports medicine devices, generating new possibilities for companies to amplify their reach.

- Increased Demand for Performance Enhancement: With a developing interest in optimizing athletic performance, sports medicine devices that offer active monitoring and tracking of performance are projected to experience considerable demand.

Kings Research says:

The sports medicine devices industry is expected to experience notable growth, influenced by technological developments, a growing focus on physical fitness, and the increasing demand for injury prevention and rehabilitation solutions. As companies stay ahead of the curve and develop more advanced, wearable, and regenerative medicine devices, the market is poised to grow, especially due to more people participating in sports and leisure activities. The integration of smart technologies and advancements in regenerative medicine will further propel technological progress and growth in the market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Sports Medicine Devices Market Size

- February-2025

- 148

- Global

- Healthcare-Medical-Devices-Biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021