Pharmacogenomics Market Size, Share, Growth & Industry Analysis, By Test Type (Genetic Testing, Pharmacogenomic Services, Diagnostic Kits), By Application (Oncology, Cardiovascular Diseases, Neurological Disorders, Infectious Diseases, Others), By End-User Industry (Hospitals, Clinics, Research & Academic Institutes, Pharmaceutical Companies), and Regional Analysis, 2024-2031

Pharmacogenomics Market: Global Share and Growth Trajectory

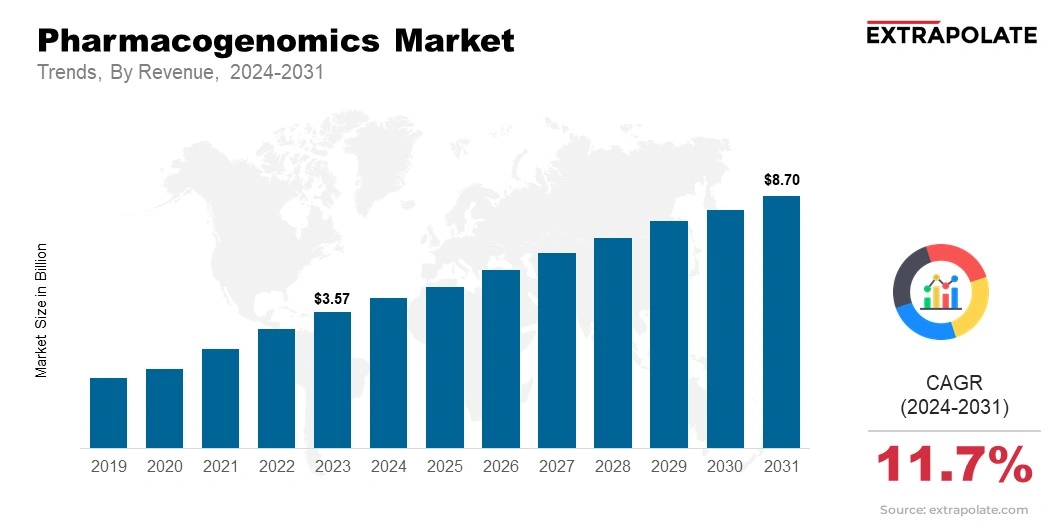

The global Pharmacogenomics Market size was valued at USD 3.57 billion in 2023 and is projected to grow from USD 4.02 billion in 2024 to USD 8.70 billion by 2031, exhibiting a CAGR of 11.7% during the forecast period.

The global pharmacogenomics market is undergoing rapid expansion, propelled by rising awareness of personalized medicine, increasing investment in genetic research, and technological advancements in genomic testing.

This market covers various aspects of pharmacogenomics, including genetic testing, bioinformatics, and companion diagnostics. The growing adoption of pharmacogenomic technologies is transforming drug development processes and improving patient care by ensuring that treatments are tailored to an individual's genetic makeup, leading to better therapeutic outcomes and fewer adverse drug reactions.

The increasing demand for precision medicine is one of the primary drivers of the market. As healthcare systems evolve toward more personalized approaches, pharmacogenomics plays a pivotal role in enabling the development of drugs that are specifically designed for individual genetic profiles.

This trend is becoming particularly evident in oncology, cardiology, and psychiatry, where pharmacogenomic testing helps doctors select the most effective drugs based on a patient’s genetic information, enhancing the efficacy of treatments and minimizing harmful side effects.

The market is set for strong growth. Focus on drug safety, efficacy, and patient care drives this. More regulatory approvals for pharmacogenomic tests and therapies boost the market. Collaborations between pharma companies and genetic research institutions highlight its growth potential.

Key Market Trends Driving Product Adoption

Several key trends are contributing to the growth of the pharmacogenomics market:

- Personalized Medicine: The focus on personalized medicine is increasing. It drives demand for pharmacogenomic testing to match patients with the most effective treatments based on their genetic profiles.

- Advancements in Genomic Technologies: Advancements in genomic sequencing and bioinformatics have made pharmacogenomics more accessible and affordable. This enables widespread adoption in clinical settings.

- Growing Awareness of Genetic Testing: As awareness of genetic testing grows, more patients and healthcare providers are adopting pharmacogenomics in treatment plans.

- Regulatory Support and Initiatives: Governments and regulators are supporting pharmacogenomics. They provide policies and funding, driving market growth further.

Major Players and their Competitive Positioning

The pharmacogenomics market is competitive. Key players lead in genetic testing, drug development, and diagnostics. Notable companies include Thermo Fisher, Roche, Illumina, Qiagen, Abbott, and Agilent. They focus on research and product development. They offer genetic testing kits, software, and diagnostic tools. These companies use partnerships, mergers, acquisitions, and R&D investments to strengthen their position.

Consumer Behavior Analysis

The adoption of pharmacogenomics is driven by several factors:

- Improved Treatment Outcomes: Patients and healthcare providers are using pharmacogenomic testing more. It ensures prescribed medications are effective and well-tolerated, leading to better treatment outcomes.

- Cost-Effective Healthcare: Pharmacogenomics reduces adverse drug reactions. It also helps optimize drug selection. This lowers healthcare costs tied to ineffective treatments and hospitalizations.

- Patient Empowerment: Pharmacogenomics gives patients more control. They can make informed decisions based on their genetic makeup. This is driving the growing adoption of these services.

- Advancements in Drug Development: Pharmaceutical companies are investing more in pharmacogenomics. They’re developing targeted therapies for specific genetic variations, creating tailored, more effective treatments.

Pricing Trends

The pharmacogenomics market's pricing relies on the complexity of genetic tests and the tech for medication creation. Genetic testing varies in price, from cheap screenings for typical gene variants to intricate, more expensive tests for uncommon genetic issues. The cost of pharmacogenomic analysis saw a decrease as sequencing technologies advanced. Despite this effective, specific treatments could still have higher prices. Better affordability and greater access to pharmacogenomics should make these services available to more people later.

Growth Factors

Several factors are propelling the growth of the pharmacogenomics market:

- Increasing Prevalence of Genetic Disorders: Genetic disorders and chronic diseases are on the rise. Cancer, heart disease, and neurological issues increase the need for pharmacogenomics to improve treatment outcomes.

- Technological Advancements in Genomic Sequencing: Sequencing tech keeps improving. Next-generation sequencing (NGS) and whole-genome sequencing (WGS) make pharmacogenomic testing faster, cheaper, and more accurate.

- Rising Demand for Personalized Medicine: Healthcare is becoming more personalized. Pharmacogenomics is key. It tailors treatments to genetic makeup. This drives the market forward.

- Favorable Government Policies: Government initiatives and investments in pharmacogenomics research are growing. Personalized medicine is also on the rise. Favorable reimbursement policies help too. These factors boost market growth. They speed up pharmacogenomics adoption in clinical practice.

Regulatory Landscape

Pharmacogenomics faces varied regulatory standards, mainly in areas such as North America and Europe. In the United States, the Food and Drug Administration (FDA) gave approval to some pharmacogenomic tests and medications on the base of genetic markers.

This approval ensures their safety and effectiveness. In Europe, pharmacogenomic products have to achieve the standards made by the European Medicines Agency (EMA) before approval happens for clinical employment.

As pharmacogenomics advances, regulatory groups labor to create guidelines and frameworks. These support the inclusion of pharmacogenomics into standard clinical work. They also guarantee patient safety.

Recent Developments

Recent developments in the pharmacogenomics market include:

- Genetic Testing Advancements: New, faster, and more affordable genetic tests have broadened access to pharmacogenomics. More healthcare providers and patients can now use these solutions.

- Increased Collaboration: Pharmaceutical firms and academic institutions are collaborating more on pharmacogenomics research. Their goal is to create more effective, genetically tailored drugs and therapies.

- Growth in Direct-to-Consumer Genetic Testing: Direct-to-consumer genetic tests from companies like 23andMe and Ancestry.com have boosted pharmacogenomics awareness. They help individuals understand genetic predispositions and make informed healthcare choices.

Current and Potential Growth Implications

Demand-Supply Analysis

The need for pharmacogenomics services will likely rise as more individuals and healthcare professionals see the advantages of tailored treatment. Technical progress in sequencing plus bioinformatics helps companies give more efficient and precise analysis on the supply side. Pharmacogenomics adoption could have problems tied to price, insurance next to the need to validate tests and treatments further.

Gap Analysis

Despite the promising growth of the pharmacogenomics market, challenges remain:

- Cost of Genetic Testing: Genetic test prices have dropped, but they’re still pricey. This keeps them out of reach for many patients, especially in places where healthcare budgets run thin.

- Data Integration and Privacy Concerns: Bringing pharmacogenomic data into clinical routines is no easy task. Keeping genetic data safe and private adds more hurdles to clear.

Top Companies in the Pharmacogenomics Market

- Thermo Fisher Scientific

- Roche

- Illumina

- Qiagen

- Abbott Laboratories

- Agilent Technologies

- Myriad Genetics

- LabCorp

- PerkinElmer

- Foundation Medicine

Pharmacogenomics Market: Report Snapshot

Segmentation | Details |

By Test Type | Genetic Testing, Pharmacogenomic Services, Diagnostic Kits |

By Application | Oncology, Cardiovascular Diseases, Neurological Disorders, Infectious Diseases, Others |

By End-User | Hospitals, Clinics, Research & Academic Institutes, Pharmaceutical Companies |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High-Growth Segments

The following market segments are expected to experience significant growth:

- Oncology: Pharmacogenomics in cancer care is growing fast. Personalized treatments, shaped by genetic profiles, are showing hopeful results.

- Cardiovascular Diseases: Cardiovascular issues are common worldwide. Pharmacogenomics steps in to fine-tune treatments and cut down on bad drug reactions.

- Neurological Disorders: Pharmacogenomics is getting noticed more. Genetically tailored treatments for neurological disorders are starting to gain real traction.

Major Innovations

Innovations in the market are focused on improving genetic testing and therapeutic development. Key innovations include:

- AI in Drug Development: Artificial intelligence and machine learning are digging into genetic data. They help predict how patients react to drugs, leading to better treatment results.

- Gene Editing Technologies: Gene editing tools like CRISPR-Cas9 are stepping into the spotlight. They allow more precise, targeted treatments in personalized medicine and pharmacogenomics.

- Next-Generation Sequencing: Next-generation sequencing (NGS) tech is speeding up genetic testing. It's now faster, cheaper, and more accurate, bringing pharmacogenomics to more people.

Potential Growth Opportunities

The market offers substantial growth opportunities:

- Expanding Clinical Applications: A deeper grasp of genomics means pharmacogenomics will have a bigger part in treating more diseases.

- Emerging Markets: More healthcare spending in growing economies along with increased need for custom treatments, makes for good chances to grow the market.

- Integration with Digital Health: When pharmacogenomics joins digital health tools, like wearables plus apps, it can improve how we watch patients and make treatments more personal.

Extrapolate Research says:

The pharmacogenomics market will likely grow significantly. This is because of a rise in demand for personalized medicine as well as developments in genomic technologies. Firms capable of innovation in areas such as genetic testing, drug creation next to therapeutic options will be leaders. The sector carries on its evolution while it uses customized methods for care.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Pharmacogenomics Market Size

- April-2025

- 148

- Global

- Healthcare-Medical-Devices-Biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021