Substation Market Size, Share, Growth & Industry Analysis, By Type (Transmission Substation, Distribution Substation, Collector Substation) By Technology (Air-Insulated (AIS), Gas-Insulated (GIS), Hybrid) By Voltage Level (High Voltage, Extra High Voltage, Ultra High Voltage) By End-User (Utilities, Industrial, Commercial, Data Centers, Renewable Sector), and Regional Analysis, 2024-2031

Substation Market: Global Share and Growth Trajectory

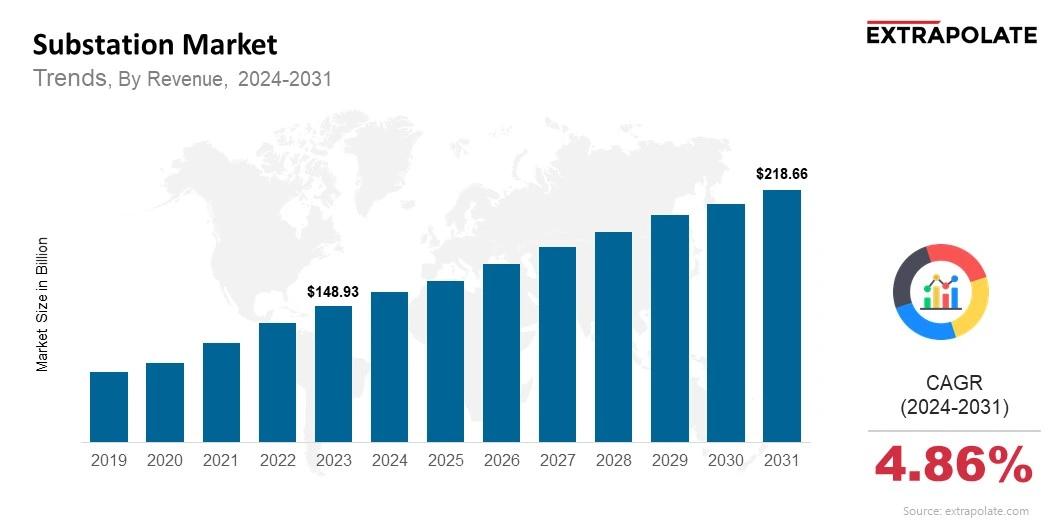

The global Substation Market size was valued at USD 148.93 billion in 2023 and is projected to grow from USD 156.82 billion in 2024 to USD 218.66 billion by 2031, exhibiting a CAGR of 4.86% during the forecast period.

The global market is booming due to increasing electricity demand, grid modernization and urbanization. Substations are the critical interface between power generation and end user delivery. As countries upgrade aging infrastructure and integrate renewables, substations are getting smarter, more efficient and more automated. This growth is driven by technology adoption, electrification of rural areas and expansion of transmission and distribution networks.

Smart grid technologies, digital controls and real time monitoring is revolutionizing substations making them essential for grid reliability and energy efficiency. Utilities are investing heavily in automation and the substation market is going to see sustained and dynamic growth.

Modern substations are evolving beyond traditional power nodes. They now have advanced protection systems, digital communication networks and automation technologies. These reduce downtime, enhance fault detection and increase system flexibility. Whether stepping down high voltages for distribution or stepping up voltages for transmission, substations are the foundation of global energy infrastructure.

Key Market Trends Driving Product Adoption

Several key trends are driving the growth and modernization of the substation market:

Smart Grid Integration: The global shift to smart grids is changing how substations operate. With digital control systems and real time analytics, substations can now talk to each other. This allows utilities to monitor loads, manage faults and improve overall grid resilience. The digital substation is fast becoming the core of future proof electricity networks.

Growth in Renewable Energy Projects: With solar, wind and hydro gaining traction, substations are adapting to handle variable energy inputs. Renewable energy often requires decentralized generation and bi-directional power flow, so substations need to be able to handle fluctuating loads and distributed energy resources. This is creating demand for flexible, automated and interoperable substations.

Urbanization and Infrastructure Expansion: As cities grow, so does their electricity consumption. Governments and utilities worldwide are building new substations and upgrading existing ones to handle increasing loads. Smart city initiatives, electric vehicle infrastructure and industrial development are all contributing to the growing need for advanced substation solutions.

HVDC Technology Growth: High Voltage Direct Current (HVDC) transmission is becoming popular for long distance and cross border energy transmission. Substations in HVDC systems convert AC to DC and DC to AC. As countries get interconnected and grid integrated HVDC substations will see significant growth.

Major Players and Their Competitive Positioning

The substation market is highly competitive, with a mix of global giants and regional players investing in technology, expansion, and customer-focused solutions. Prominent industry players include: ABB Ltd., Siemens AG, General Electric Company, Schneider Electric SE, Mitsubishi Electric Corporation, Eaton Corporation PLC, Toshiba Energy Systems & Solutions, CG Power and Industrial Solutions Ltd., Hyosung Heavy Industries, Larsen & Toubro Limited.

These firms are actively pursuing digitalization, sustainability, and automation. Strategic partnerships, acquisitions, and R&D investments are common approaches to maintain competitive advantage and address rising demand for advanced substations.

Consumer Behavior Analysis

The substation procurement and investment decision is influenced by many economic, technical and operational factors:

Reliability and Operational Efficiency: Utilities and industries are prioritizing reliability, uptime and power distribution. Substations with digital control systems, real-time diagnostics and remote monitoring are getting more popular. This is seen in both new installations and retrofitting of old systems.

Cost-Benefit of Automation: While advanced substation technologies may require higher upfront investment, the long term benefits – reduced operational cost, lower failure rate and better asset management – make sense. Stakeholders are recognizing the total lifecycle value and hence adoption is increasing.

Modular and Scalable Solutions: Customers are preferring modular substations which are faster to install, easier to scale and adaptable to site specific requirements. This trend is more pronounced in remote areas and renewable energy projects where flexibility is key.

Sustainability and Environmental Concerns: With environmental regulations getting tighter, users are considering the environmental footprint of substation components. Low emission switchgear, compact design and recyclable materials are getting attention in procurement decisions.

Pricing Trends

Pricing of substation components and systems varies greatly based on voltage level, configuration (AIS vs GIS), automation level and region. Air insulated substations (AIS) are more cost effective in rural or open areas, while gas insulated substations (GIS) are more expensive due to compact footprint and higher protection, hence suitable for urban areas.

Costs can also be influenced by:

- Customization for specific applications

- Integration of smart sensors and communication protocols

- Installation and commissioning services

- Supply chain disruptions and raw material pricing

Digital substations have higher capital expenditure but better operational efficiency and long term savings through predictive maintenance and automated controls. Leasing and service based models are gaining traction as utilities want to spread the investment over time.

Growth Factors

Several forces are driving global substations demand:

Expansion of Transmission and Distribution Networks: As countries are trying to electrify rural areas and urban infrastructure, the expansion of grid networks naturally drives the need for substations. This trend is more pronounced in Asia-Pacific, Africa and Latin America.

Industrial and Commercial Demand: Industrialization is happening fast in emerging markets and that is driving electricity demand. Factories, data centers, transportation systems and commercial buildings all need robust power infrastructure supported by efficient substations.

Modernization of Aging Infrastructure: Many developed countries are facing aging electrical infrastructure. Retrofitting old substations with modern components, digital protection systems and automation is critical to improve reliability and meet future power demand.

Government Support and Investments: Infrastructure development programs and policy incentives – especially those supporting renewable integration and grid modernization – are encouraging utilities and private players to invest in substations.

Regulatory Landscape

Substations being critical infrastructure are governed by strict standards and regulations for safety, interoperability and performance:

- IEEE Standards: Widely used in North America, IEEE standards cover substation design, grounding, protection systems and communication protocols.

- IEC Standards: Common in Europe and other global markets, IEC standards focus on equipment design, testing and performance.

- National Grid Codes: Country specific regulations govern how substations interface with the wider transmission or distribution grid.

- Environmental Compliance: Regulations such as SF6 gas handling, noise limits and electromagnetic field exposure guidelines impact equipment choice and design.

- Cybersecurity Frameworks: With digital substations on the rise, cybersecurity has become a major regulatory focus. Protocols like IEC 62351 and NERC CIP are implemented to ensure resilience against cyber threats.

Recent Developments

The substation market has seen several noteworthy developments:

- Digital Substations: Utilities in Europe and North America are leading the charge in deploying fully digital substations. These offer data acquisition, automated fault handling and predictive maintenance capabilities.

- Eco-Friendly Switchgear: There’s investment in SF6 free switchgear to reduce greenhouse gas emissions and meet sustainability goals.

For instance, in May 2025, Hitachi Energy launched the EconiQ 550 kV SF₆-free GIS in collaboration with the State Grid Corporation of China. This marks the world’s first gas-insulated switchgear at this voltage level to operate without SF₆. The system delivers equivalent performance and compactness to conventional GIS while eliminating a greenhouse gas with a global warming potential 24,300 times greater than COâ‚‚, supporting the transition to sustainable grid infrastructure.

- Mobile and Containerized Substations: These are becoming popular for temporary power supply needs in construction sites, mining operations and disaster struck areas.

- Global Infrastructure Investments: Large energy infrastructure projects like India’s Revamped Distribution Sector Scheme (RDSS) and China’s Belt and Road Initiative are pumping money into substation upgrades and new builds.

Current and Potential Growth Implications

Demand-Supply Analysis: As global demand for electricity increases, utilities are building more substations to stabilize and expand their grids. But supply chain challenges for components like transformers and switchgear are delaying deployments.

Gap Analysis: While the market is growing, there’s a big gap in digital adoption in developing regions. High initial costs and lack of technical expertise is hindering digital substation adoption in some low income countries. Bridging this gap is a big opportunity.

Top Companies in the Substation Market

- ABB Ltd.

- Siemens AG

- General Electric Company

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Eaton Corporation PLC

- Toshiba Energy Systems & Solutions

- CG Power and Industrial Solutions Ltd.

- Hyosung Heavy Industries

- Larsen & Toubro Limited

Substation Market: Report Snapshot

Segmentation | Details |

By Type | Transmission Substation, Distribution Substation, Collector Substation |

By Technology | Air-Insulated (AIS), Gas-Insulated (GIS), Hybrid |

By Voltage Level | High Voltage, Extra High Voltage, Ultra High Voltage |

By End-User | Utilities, Industrial, Commercial, Data Centers, Renewable Sector |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Substation Market: High-Growth Segments

- Gas-Insulated Substations (GIS): Fastest growing in space-constrained urban areas and coastal regions where environmental conditions are harsh.

- Digital Substations: Automation, predictive maintenance and energy management. Digitalization of substations is the fastest growing segment globally.

- Renewable Sector Deployments: Substations for solar and wind power integration, especially in China, India and US are driving demand.

Major Innovations

Innovations reshaping the substation market include:

- IoT and SCADA : IoT devices and SCADA systems are enabling real-time monitoring and remote control.

- AI-Based Predictive Maintenance: AI algorithms are being used to predict faults and schedule maintenance, reducing unplanned outages and equipment wear.

- SF6-Free Switchgear: Eco-friendly alternatives to traditional SF6 gas switchgear are being developed and adopted to reduce carbon footprint.

Substation Market: Potential Growth Opportunities

- Emerging Market Electrification: Countries in Africa, Southeast Asia and Latin America are electrifying, presenting huge demand for cost effective substation solutions.

- Upgrades for Renewable Integration: As intermittent renewables become more common, substations will need to become more dynamic and digital to manage grid stability.

- Decentralized Energy Networks: Growth in distributed energy resources (DERs) is driving demand for localized substations that can handle bi-directional energy flows.

Extrapolate Research says:

The substation market is expected to grow exponentially in the next decade. With electricity demand rising, grid modernization underway and renewables surging, substations are at the heart of the energy transition. Innovations in digital and infrastructure investments will continue to shape the market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Substation Market Size

- July-2025

- 148

- Global

- Energy-and-Power

Related Research

Organic Rankine Cycle Market Size, Share, Growth & Industry Analysis, By Application (Solar Thermal

February-2023

Air Electrode Battery Market Size, Share, Growth & Industry Analysis, By Product (Zinc-Air Batteries

September-2024

Battery Recycling Market Size, Share, Growth & Industry Analysis, By Battery Chemistry (Lead-Acid, L

August-2025

Biodiesel Market By Feedstock (Soybean, Rapeseed, Palm, Palm, Poultry, Tallow, White Grease, and Oth

January-2023

Biomass Boiler Market Size, Share, Growth & Industry Analysis, By Product Type (Fully Automated Boil

August-2025

Biomass Power Generation Market Size, Share, Growth & Industry Analysis, By Feedstock (Woody Biomass

August-2025

Biomethane Market by Application (Automotive, Power Generation, and Others), Production Method (Ferm

February-2023

Cable Entry Systems and Components Market Size, Share, Growth & Industry Analysis, By Product Type (

February-2025

Carbon Capture and Storage Market Size, Share, and COVID-19 Impact Analysis, By Capture Source (Chem

August-2025

Diesel Market Size, Share, Growth & Industry Analysis, By Application (Transportation (On-road, Off-

April-2025