Electrical Conduit Market Size, Share, Growth & Industry Analysis, By Type (Rigid Conduit, Flexible Conduit, Intermediate Metal Conduit (IMC), Electrical Metallic Tubing (EMT), Liquid Tight Flexible Conduit) By Material (Metallic (Steel, Aluminium), Non-Metallic (PVC, HDPE, Nylon)) By End-Use (Residential, Commercial, Industrial, Utility), and Regional Analysis, 2024-2031

Electrical Conduit Market: Global Share and Growth Trajectory

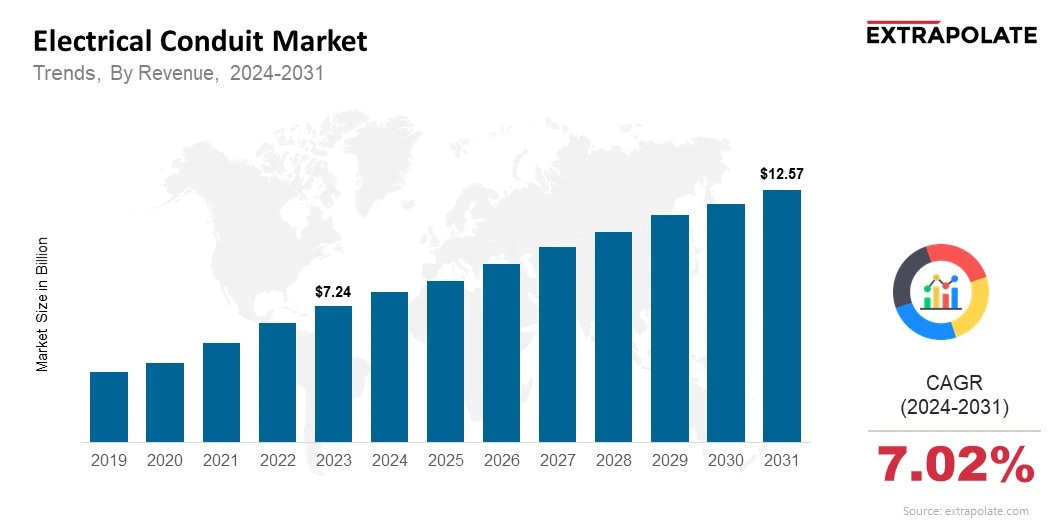

Global Electrical Conduit Market size was recorded at USD 7.24 billion in 2023, which is estimated to be valued at USD 7.81 billion in 2024 and reach USD 12.57 billion by 2031, growing at a CAGR of 7.02% during the forecast period.

The global electrical conduit market is growing as the demand for efficient and safe power transmission systems increases worldwide. Electrical conduits are a part of any building infrastructure, they are the protective pathway for electrical wiring in industrial, commercial and residential applications.

They play a vital role in shielding wires from mechanical damage, moisture and chemical exposure to maintain operational safety and performance integrity. As industries modernize and cities go smart, electrical conduits have become the essential tool in future ready construction and energy frameworks.

Key drivers for the market growth are urbanization, stringent safety regulations and increased investments in infrastructural development globally. Governments and regulatory bodies are emphasizing on safe wiring installations especially in new construction and retrofit projects which in turn is driving the demand for advanced conduit solutions.

Shift towards renewable energy and expansion of data centers and industrial automation also contributing to growing conduit installations.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Urbanization and Infrastructure Development

Rapid urbanization especially in emerging economies is the primary driver for increased electrical conduit deployment. As cities expand and housing, commercial complexes and industrial zones multiply, the need for organized safe electrical networks grows in parallel. Electrical conduits provide the structural support and safety framework for these networks to function effectively.

Electrical Safety and Regulatory Compliance

Governmental mandates on fire safety, electric code compliance and standardization of electrical installations are compelling stakeholders to use high quality conduit systems. Products made from materials like galvanized steel, aluminium and rigid PVC are increasingly preferred due to their durability, non-combustibility and compliance to national and international safety norms.

Renewable Energy and Data Center

Electrical conduits are playing a bigger role in renewable energy systems like solar and wind farms. These installations require weather resistant, flexible conduits to secure long distance power lines and complex electrical systems. Similarly, the growing number of hyperscale data centers is driving the need for cable management solutions that include conduits to house and protect dense wiring arrays.

Technological Advancements in Conduit Materials

Innovation in materials like development of halogen free, flame retardant and corrosion resistant polymers, has improved conduit performance. These innovations cater especially to high risk and mission critical environments like healthcare, aerospace and marine sectors where operational integrity and safety is paramount.

Major Players and Their Competitive Positioning

The market is competitive and has many players: - Atkore International Group Inc., ABB Ltd., Schneider Electric SE, Eaton Corporation PLC, Legrand S.A., HellermannTyton Group PLC, Aliaxis Group S.A., Calpipe Industries Inc., Dura-Line Holdings Inc., ANAMET Electrical Inc.

These These companies are expanding their production capabilities and launching product lines that meet changing regulatory environments and customer preferences. Strategic acquisitions – like Eaton’s purchase of Cooper Industries – and partnerships with construction and energy companies have increased their global market share and product visibility.

In February 2023, Atkore launched its Calbond product line with the introduction of PVC Coated Colour Conduit in six standard colours (red, orange, yellow, blue, green, white). This corrosion-resistant conduit is the only ETL-verified colour conduit in the market and meets UL 6 safety standards. It was introduced to enhance visual circuit identification and simplify maintenance in critical industrial applications like pharmaceuticals and wastewater facilities.

Consumer Behaviour Analysis

Safety and Reliability is Key to Product Choice

End-users – especially contractors and utility providers prioritise conduit systems that offer greater durability, fire resistance and reliability in various environmental conditions. As electrical accidents and downtime increase, buyers are looking for tried and tested brands that deliver consistent performance and meet international standards.

Price Sensitivity Varies by Application

While price sensitivity exists in residential, commercial and industrial users opt for premium conduit systems due to higher load bearing and safety requirements. However, budget constraints in public infrastructure projects may sometimes force stakeholders to choose cost effective yet compliant solutions, thus driving demand for low cost conduits.

Ease of Installation is Key

Time and labour savings are key decision drivers. Flexible, lightweight conduit systems made from PVC or HDPE are popular as they reduce installation time and require fewer fittings. Hence vendors are marketing products that speed up installation and reduce total cost of ownership.

Green Building Standards on the Rise

Sustainability conscious customers are demanding environmentally friendly conduit systems that meet green building standards like LEED (Leadership in Energy and Environmental Design). Recyclable and non-toxic materials are gaining traction especially in regions with environmental regulations.

Pricing Trends

Pricing in the electrical conduit market is influenced by raw material cost, labour, manufacturing complexity and regulatory compliance. Metal conduits like steel and aluminum are generally more expensive due to material strength and fire resistance properties. However, metal price fluctuations can impact market stability. Plastic conduits especially PVC are more affordable and are used in low to medium load applications.

Pricing transparency has also increased with the rise of e-commerce platforms that offer quotes. Value added services like pre-cut lengths, corrosion resistant coatings and smart conduit tracking systems (RFID-tagged) add to the premium pricing. Bulk buying for commercial and industrial projects often comes with discounts and installation services bundled.

Growth Factors

Growing Emphasis on Smart Infrastructure

Governments and private sectors are investing in smart cities and digital infrastructure which requires advanced electrical systems and reliable wiring solutions. Electrical conduits are key to this transition, providing organized cable pathways and future-proofing installations.

Rising Power Demand and Electrification

Global power demand is increasing due to population growth, urbanization and electrification of transportation and industry. This presents huge opportunities for conduit manufacturers especially in developing economies where electrification rates are still growing.

Construction Industry Growth

New construction projects across residential, commercial and industrial segments directly impact conduit consumption. Smart homes, offices, airports and manufacturing plants are increasingly relying on high capacity, code compliant conduit systems to accommodate growing electrical loads.

Technology in Product Offerings

Manufacturers are now embedding smart features like cable monitoring sensors and heat detection modules in conduit systems. These innovations enhance operational safety and enable predictive maintenance giving vendors a competitive edge and users long term value.

Regulatory Landscape

Electrical conduit manufacturing and installation is governed by strict regulatory frameworks to ensure public and workplace safety. National Electrical Code (NEC) in US, IEC standards in Europe and various regional codes specify the materials, installation methods and testing protocols for conduit systems. Compliance to these codes is mandatory for getting project approvals and government tenders.

Additionally, environmental regulations now require manufacturers to adopt sustainable production methods and limit the use of hazardous substances. Certifications like RoHS (Restriction of Hazardous Substances), ISO 9001 and UL (Underwriters Laboratories) listings are becoming industry norms.

Recent Developments

- Atkore International launched its “Next-Gen PVC Coated Conduit” series for superior corrosion resistance for offshore and chemical plant applications.

- Schneider Electric introduced new line of flexible conduits for robotic and motion heavy industrial applications.

- Legrand S.A. acquired a regional conduit manufacturer in Southeast Asia to expand its presence in emerging markets with high electrification demand.

- Dura-Line partnered with a solar energy company to supply conduit infrastructure for large scale solar farms across North America.

- ABB Ltd. launched smart conduit with temperature and fault monitoring capabilities for enhanced system diagnostics in high load facilities.

These are the developments in the market, key players are investing in innovation, expansion and customer centric solutions.

Demand-Supply Analysis

Demand for electrical conduits is outstripping supply in some of the fast growing regions especially in Asia-Pacific and Africa. Rapid growth combined with supply chain disruptions and raw material scarcity has created short term bottlenecks. But companies are increasing production and setting up local manufacturing units to mitigate these constraints and serve regional markets better.

Gap Analysis

Despite strong demand there is a big gap in affordability and accessibility of high performance conduit systems in developing regions. Small and medium contractors are relying on informal market channels where product quality is inconsistent. Addressing this through standardized and affordable offerings can unlock huge untapped market.

Top Companies in the Electrical Conduit Market

- Atkore International Group Inc.

- ABB Ltd.

- Schneider Electric SE

- Eaton Corporation PLC

- Legrand S.A.

- Aliaxis Group S.A.

- HellermannTyton Group PLC

- Calpipe Industries Inc.

- Dura-Line Holdings Inc.

- ANAMET Electrical Inc.

Electrical Conduit Market: Report Snapshot

Segmentation | Details |

By Type | Rigid Conduit, Flexible Conduit, Intermediate Metal Conduit (IMC), Electrical Metallic Tubing (EMT), Liquid Tight Flexible Conduit |

By Material | Metallic (Steel, Aluminum), Non-Metallic (PVC, HDPE, Nylon) |

By End-Use | Residential, Commercial, Industrial, Utility |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Electrical Conduit Market: High-Growth Segments

- Flexible Conduits: With their ease of installation and ability to bend around obstacles, flexible conduits are gaining popularity, particularly in retrofit and renovation projects.

- Non-Metallic Conduits: PVC and HDPE conduits are expected to grow rapidly due to their lightweight nature, affordability, and corrosion resistance, especially in humid and chemical-exposed environments.

- Commercial and Industrial End-Use: The booming commercial real estate and manufacturing sectors are propelling demand for high-capacity, fire-resistant conduits that meet stringent building codes.

Major Innovations

- Smart Conduits: Embedded with sensors for real-time temperature and fault monitoring, these conduits are paving the way for predictive maintenance and operational safety.

- Halogen-Free and Flame-Retardant Materials: Developed for high-risk environments like subways and data centers, these conduits minimize toxic emissions and improve evacuation safety.

- Pre-Fabricated Conduit Systems: Pre-assembled conduit modules reduce on-site installation time and labor costs, proving ideal for time-sensitive construction projects.

Electrical Conduit Market: Potential Growth Opportunities

- Adoption in Smart Cities: The ongoing development of smart cities creates an urgent need for efficient, organized electrical systems, making advanced conduit solutions essential infrastructure components.

- Expansion in Developing Economies: Rapid industrialization and government-led electrification efforts in Africa and Asia-Pacific are unlocking significant opportunities for market expansion.

- Integration with Renewable Energy Projects: Solar, wind, and EV charging stations require robust conduit infrastructure for safe power transmission—an emerging application area for manufacturers.

Extrapolate says:

The electrical conduit market is poised for robust growth, propelled by global electrification trends, infrastructure modernization, and the adoption of safe wiring practices. The integration of smart technologies into conduit systems and the shift toward sustainable materials are transforming how electrical infrastructure is built and maintained. With rising demand from industrial automation, renewable energy, and smart cities, the market presents vast opportunities for innovation and expansion. Companies that prioritize regulatory compliance, product innovation, and regional diversification are likely to secure a strong competitive edge in the years ahead.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Electrical Conduit Market Size

- August-2025

- 140

- Global

- Energy-and-Power

Related Research

Organic Rankine Cycle Market Size, Share, Growth & Industry Analysis, By Application (Solar Thermal

February-2023

Air Electrode Battery Market Size, Share, Growth & Industry Analysis, By Product (Zinc-Air Batteries

September-2024

Battery Recycling Market Size, Share, Growth & Industry Analysis, By Battery Chemistry (Lead-Acid, L

August-2025

Biodiesel Market By Feedstock (Soybean, Rapeseed, Palm, Palm, Poultry, Tallow, White Grease, and Oth

January-2023

Biomass Boiler Market Size, Share, Growth & Industry Analysis, By Product Type (Fully Automated Boil

August-2025

Biomass Power Generation Market Size, Share, Growth & Industry Analysis, By Feedstock (Woody Biomass

August-2025

Biomethane Market by Application (Automotive, Power Generation, and Others), Production Method (Ferm

February-2023

Cable Entry Systems and Components Market Size, Share, Growth & Industry Analysis, By Product Type (

February-2025

Carbon Capture and Storage Market Size, Share, and COVID-19 Impact Analysis, By Capture Source (Chem

August-2025

Diesel Market Size, Share, Growth & Industry Analysis, By Application (Transportation (On-road, Off-

April-2025