Soft Magnetic Composite Market Size, Share, Growth & Industry Analysis, By Material Type (Iron Powder, Ferrite Powder, Others), By Application (Motors, Transformers, Inductors, Generators, Sensors), By End-User (Automotive, Electrical & Electronics, Energy, Aerospace, Industrial), and Regional Analysis, 2024-2031

Soft Magnetic Composite Market: Global Share and Growth Trajectory

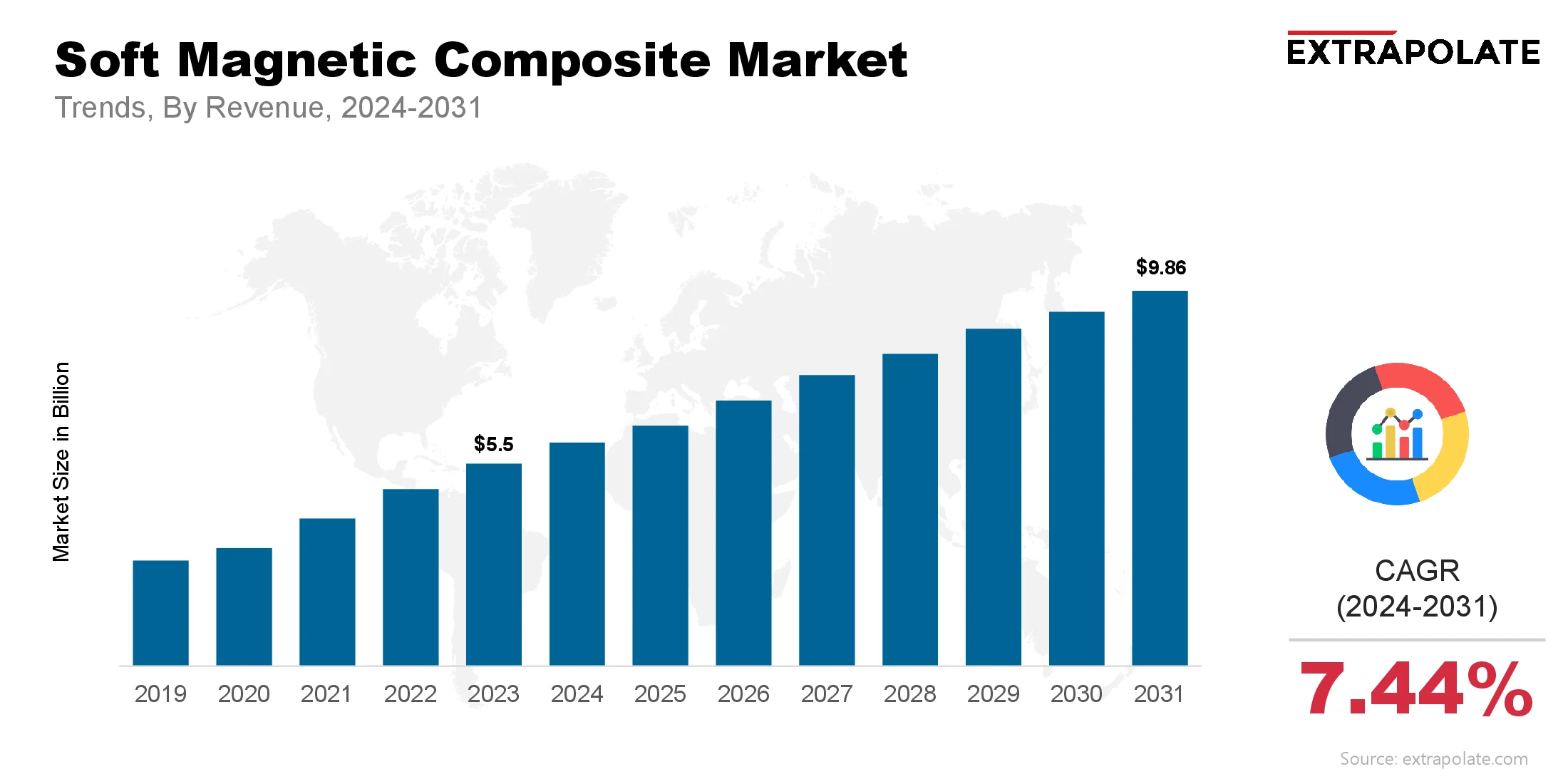

The global Soft Magnetic Composite Market size was valued at USD 5.5 billion in 2023 and is projected to grow from USD 5.96 billion in 2024 to USD 9.86 billion by 2031, exhibiting a CAGR of 7.44% during the forecast period.

The global soft magnetic composite (SMC) market is growing as demand for energy efficient components across various industries is increasing. These composites made of insulated iron powder have excellent magnetic performance and high electrical resistivity and are essential in applications where core losses and compact motor designs are required.

The SMC market is gaining momentum as industries are looking for lighter, more efficient and high performance materials for electric motors, transformers, inductors and other electromagnetic components. Key sectors like automotive, electronics, energy and industrial machinery are incorporating SMCs in their product lines to leverage their thermal and magnetic benefits. Electrification of transportation and the broader shift towards renewable energy is driving this market.

Advances in material science and processing techniques have expanded the scope of SMCs, making them applicable in next generation electric machines and components. As innovation continues and sustainability goals align with the performance benefits of SMCs, the market is expected to grow steadily globally.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Electric Vehicles (EVs)

One of the biggest trends impacting the soft magnetic composite market is the surge in electric vehicle production. SMCs are ideal for electric motors as they have 3D flux capability, lightweight and reduced eddy current losses. As global automakers are investing heavily in EV development, they are turning to SMCs for use in traction motors, onboard chargers and auxiliary systems.

SMCs help in reducing energy losses hence increasing the overall efficiency of EV powertrains. This is why they are being used not just in passenger vehicles but also in commercial electric fleets and two wheelers. So demand from EV segment is emerging as a key growth driver.

Miniaturization and High Frequency Applications

Electronics trends are favoring the use of compact, efficient magnetic components that can operate at high frequencies. Soft magnetic composites allow innovative designs in inductors, chokes and power supplies where space and weight are critical.

SMCs can operate efficiently at higher frequencies and temperatures without significant losses and are better than laminated steel cores in many applications. The shift towards miniaturized electronics and smaller yet more powerful components is driving adoption.

Renewable Energy Segment

As renewable energy systems like wind and solar power grow, efficient magnetic materials are required for energy conversion and power generation. SMCs are being used in generators and inverters as they improve energy efficiency and reduce heat and weight.

Smart grids and energy storage systems are also increasing the use of soft magnetic composites in transformers and power conversion systems, making them a key player in the energy transition.

High-Performance Industrial Motors on the Rise

Industries are investing in motor upgrades and replacements that are more efficient and have lower emissions. SMCs play a key role in developing next-gen motors that require less maintenance and are quieter. Applications range from robotics and automation to HVAC and home appliances where SMCs improve magnetic performance and energy savings.

With Industry 4.0 pushing for smart and efficient machines, demand for high-performance motors using SMCs is growing.

Major Players and their Positioning

The soft magnetic composite market is an innovation driven competition where key players are continuously developing new materials, improving processing techniques and expanding into new industries. Companies are strengthening their position through strategic partnerships, acquisitions and R&D initiatives.

Key players are Höganäs AB, Hitachi Metals Ltd., GKN Powder Metallurgy, Fluxtrol Inc., Rio Tinto Metal Powders, Sintertech, Samvardhana Motherson Group, Mate Co., Ltd., Powdertech Co., Ltd., Steward Advanced Materials and others.

These players are actively developing proprietary materials and custom SMC formulations tailored to the needs of specific sectors, such as automotive, industrial automation, and renewable energy.

In January 2024, JFE Steel, in collaboration with JFE Techno‑Research Corporation and Armis Corporation, unveiled an axial-gap motor prototype using Denjiro. This motor design delivers same power as conventional radial-gap motors but is 48% thinner and 40% lighter.

In June 2025, Höganäs AB launched re-Astaloy 85 Mo, the first product in its re-portfolio of sustainability-focused materials. This pre-alloyed iron powder demonstrates a reduced carbon footprint of approximately 14%, achieved through the integration of biogas in the manufacturing process. In March 2025, the company’s Somaloy family of soft magnetic composite powders received independent verification for its carbon footprint data. This certification enhances transparency and supports customers' environmental reporting requirements, particularly for automotive and industrial applications.

Consumer Behavior

- Efficiency and Performance Expectations: Consumers across industries are looking for materials that improve energy efficiency without compromising performance. This is driving the adoption of SMCs especially among motor and transformer manufacturers who prioritize reduced core losses, lower weight and smaller component sizes.

- Cost vs Performance Trade-offs: While SMCs outperform in many applications, adoption is constrained by higher production cost compared to traditional magnetic materials. End-users are more likely to adopt SMCs when the efficiency gains and product life offset the initial investment. The growing focus on lifecycle cost savings is shifting the equation in favor of SMCs.

- Environmental Awareness: Consumers and industries are looking for materials that support sustainability. SMCs being recyclable and reducing energy losses align with eco-friendly practices. As regulatory and consumer focus on environmental performance increases, SMCs are seen as a sustainable option.

- Customization: Manufacturers and OEMs are asking for magnetic properties and component design. As a result the SMC market is seeing more activity in custom formulations and geometry specific solutions, more interaction between suppliers and end-users during product development phases.

Pricing Trends

Pricing for soft magnetic composites (SMCs) varies depending on powder formulation, insulation coating, application and volume. High end applications in automotive or aerospace will use premium grade SMCs and priced accordingly. Bulk industrial grade composites will benefit from economies of scale.

In recent years advances in powder metallurgy and scalable production processes have driven down costs and made SMCs more competitive with laminated steels. However prices are still higher due to the complexity of insulation coatings and specialized equipment needed for compacting and sintering.

As demand grows and new suppliers enter the market prices will moderate and accelerate adoption in price sensitive markets.

Growth Drivers

- Electrification of the Automotive Sector: The push for electrification across all modes of transportation – passenger vehicles, buses, two wheelers, commercial fleets – is the biggest growth driver for SMCs. Their lightweight and high efficiency nature makes them critical to meet energy efficiency and emission standards.

- Advancements in Magnetic Materials: Research in material engineering is unlocking new opportunities for SMCs. Improved insulation coatings, higher thermal stability and better mechanical strength is expanding their use in high performance applications like aerospace and defense.

- Urbanization and Infrastructure Development: Rapid urbanization is driving infrastructure development especially in Asia-Pacific and Middle East. This includes expanding power distribution networks, smart grids and renewable energy systems – all of which require efficient magnetic components supported by SMCs.

- Regulatory Push for Energy Efficiency: Global regulations to improve energy efficiency in electric motors and transformers are forcing OEMs to replace legacy components with new ones. SMCs meet these new efficiency standards and are therefore essential components in next gen designs.

Regulatory Landscape

The SMC market is governed by strict regulations for safety, quality and environmental sustainability. Some of the key regulatory standards and frameworks are:

- IEC Standards: These standards define the performance criteria for magnetic materials used in electrical equipment.

- RoHS and REACH: European environmental compliance regulations restrict the use of hazardous substances, encouraging the use of safe, recyclable materials like SMCs.

- ISO Certifications: Quality management systems like ISO 9001 and ISO 14001 ensure SMC production meets environmental and operational standards.

- Government Policies: Incentives for electric vehicle production, energy efficient appliances and renewable energy technologies indirectly boost demand for SMCs.

Compliance to these frameworks is crucial for manufacturers to maintain market credibility and access international markets.

Recent Developments

- Höganäs Expands SMC Production: Höganäs AB, a global leader in metal powders, has increased its production capacity to meet growing SMC demand from automotive and industrial sectors.

- Partnerships in E-Mobility: GKN Powder Metallurgy has partnered with several automotive OEMs to co-develop electric motor components using advanced SMCs for better energy efficiency and reduced weight.

- Innovative High-Frequency Materials: Companies like Fluxtrol Inc. and Steward Advanced Materials are developing SMCs for high-frequency applications in electronics, expanding their market reach.

- R&D on Insulation Technologies: Manufacturers are investing in developing better insulation techniques to improve SMC magnetic performance, especially for motors operating at high temperatures.

These developments show the SMC market is evolving fast with innovation and collaboration across industries.

Current and Potential Growth Implications

a. Demand-Supply Analysis: Growing demand for energy efficient components is putting pressure on high performance magnetic materials. Manufacturers are ramping up capacity but raw material and coating technology bottlenecks remain.

Regional supply gaps also exist, Asia-Pacific is the dominant producer and consumer, while Latin America and Africa are still in the early stages of SMC adoption.

b. Gap Analysis: One of the biggest challenge in the SMC market is the affordability gap. Although performance benefits are clear, high material and tooling costs are hindering adoption especially for small and medium enterprises. Addressing this through scalable production and innovation in cost effective insulation technologies is key to market growth.And training.

Top Companies in the Soft Magnetic Composite Market

- Höganäs AB

- GKN Powder Metallurgy

- Hitachi Metals Ltd.

- Rio Tinto Metal Powders

- Fluxtrol Inc.

- Steward Advanced Materials

- Mate Co., Ltd.

- Samvardhana Motherson Group

- Powdertech Co., Ltd.

- Sintertech

Soft Magnetic Composite Market: Report Snapshot

Segmentation | Details |

By Material Type | Iron Powder, Ferrite Powder, Others |

By Application | Motors, Transformers, Inductors, Generators, Sensors |

By End-User | Automotive, Electrical & Electronics, Energy, Aerospace, Industrial |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Automotive Motors: Electric motors made with SMCs are revolutionizing vehicle design, enabling greater efficiency and compactness. This segment is expected to dominate the market due to rising EV adoption.

- Industrial Transformers: Transformers leveraging SMCs for core construction offer reduced energy losses and improved thermal management, driving their adoption in factories and smart grids.

- High-Frequency Electronics: The demand for miniaturized inductors and power supply components in consumer electronics and communication devices supports rapid growth in this segment.

Major Innovations

- Hybrid Magnetic Composites: Researchers are developing hybrid materials that combine soft magnetic and thermal conductive properties, improving component longevity and performance in high-load environments.

- Additive Manufacturing Integration: Efforts are underway to 3D print SMC-based parts, allowing for more complex geometries and improved magnetic flux designs—particularly advantageous for motor applications.

- Insulation Coating Advancements: Innovations in nanocoating and resin-based insulation are enhancing the durability and magnetic properties of SMCs, opening new application areas in harsh environments.

Potential Growth Opportunities

- Expansion into Emerging Markets: Countries in Southeast Asia, Africa, and Latin America are expanding industrial and energy infrastructure. SMCs present an opportunity for localized, energy-efficient component manufacturing.

- AI and IoT Integration: With the rise of smart motors and connected devices, SMCs can play a crucial role in enabling real-time monitoring, self-diagnostics, and intelligent control in motor systems.

- Sustainable Product Design: Companies aiming for carbon neutrality and green product development are turning to SMCs to meet environmental benchmarks and energy-efficiency targets.

Extrapolate Research Says:

The soft magnetic composite market is positioned for robust growth in the coming years. As global industries transition toward electrification, efficiency, and sustainability, the demand for high-performance magnetic materials will continue to climb.

SMCs offer a compelling solution by enabling compact, energy-efficient designs across electric vehicles, industrial automation, renewable energy, and consumer electronics. With technological advances and regulatory support aligning favorably, the market is expected to witness a surge in innovation and adoption propelling it into a new era of growth and transformation.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Soft Magnetic Composite Market Size

- August-2025

- 140

- Global

- Chemicals-and-Advanced-Materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021