Refractories Market Size, Share, Growth & Industry Analysis, By Product Type (Shaped Refractories, Unshaped (Monolithic) Refractories) By Material (Alumina, Silica, Magnesia, Zirconia, Carbon, Others) By Application (Steel, Cement, Glass, Non-Ferrous Metals, Petrochemicals, Others) By End-User (Iron & Steel Industry, Cement Industry, Glass Industry, Non-metallic Industry, Others), and Regional Analysis, 2024-2031

Refractories Market: Global Share and Growth Trajectory

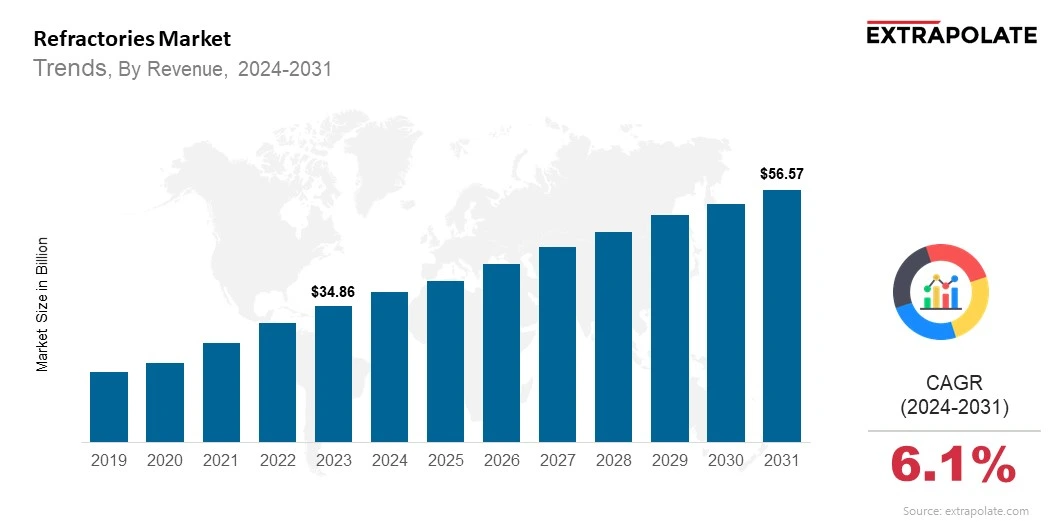

The global Refractories Market size was valued at USD 34.86 Billion in 2023 and is projected to grow from USD 37.31 Billion in 2024 to USD 56.57 Billion by 2031, exhibiting a CAGR of 6.1% during the forecast period.

The global market is growing steadily as industrial activity increases and demand for high temperature materials across key sectors grows. Refractories – materials that can withstand extreme heat, chemical corrosion and mechanical wear – are critical in industries like iron and steel, cement, glass, non-ferrous metals and petrochemicals. As infrastructure development accelerates and heavy industry modernises the use of advanced refractories is growing globally.

Asia-Pacific leads the global market, accounting for the largest share in production and consumption. This is driven by the presence of major steel and cement manufacturing hubs in China, India, Japan and South Korea. North America and Europe are focused on sustainability and recycling of used refractories. Latin America and Middle East & Africa are seeing increased adoption as industrial investments and urban development initiatives grow.

The market is also driven by the growing demand for monolithic refractories which offer better performance, easier installation and less downtime than traditional shaped bricks. Technological innovations like nano-structured refractories and low-cement castables are further improving product efficiency and life.

Sustainability trends are changing the industry with more emphasis on eco-friendly raw materials and energy efficient manufacturing processes. Recycling is becoming a strategic priority for key players.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several major trends are propelling the widespread adoption of refractories:

• Steel and Cement Production Boom:- Global construction and infrastructure development is leading to increased steel and cement production. Both industries are big consumers of refractories, especially in furnaces, kilns, incinerators and reactors. This is more pronounced in emerging markets where urbanization and industrialization is happening fast.

• Monolithic Refractories:-Monolithic refractories are replacing traditional shaped bricks due to better performance, lower installation cost and ease of application. These materials have good mechanical strength and thermal resistance, ideal for lining furnaces and high temperature environments.

• Sustainability and Recycling:-With global push towards sustainability, the refractories market is moving towards eco-friendly solutions. Recycling of used refractory materials is gaining popularity especially in developed markets. This reduces environmental impact and cost of production.

• Refractory Technologies:-Technological innovation is enabling development of advanced refractories with higher thermal conductivity, corrosion resistance and lifespan. These high performance materials are being used in sophisticated industrial applications like aerospace, petrochemicals and electric arc furnaces in steel production.

Major Players and their Competitive Positioning

The refractories market is highly competitive, with key players investing in R&D and strategic initiatives to enhance their market positions. Leading companies in this space include: RHI Magnesita, Vesuvius plc, Krosaki Harima Corporation, HarbisonWalker International, Morgan Advanced Materials, Imerys, Shinagawa Refractories Co., Ltd., Resco Products, Refratechnik Group, Calderys.

These companies are leveraging product innovations, mergers and acquisitions, and strategic collaborations to gain competitive advantages. The focus is also on expanding manufacturing capabilities in high-demand regions such as Asia-Pacific and the Middle East.

Consumer Behavior Analysis

Consumer behaviour in the refractories industry is driven by a combination of operational, economic and regulatory factors:

- Preference for Durability and Performance:- End-users are preferring high quality refractories that offer longer service life and higher thermal shock and abrasion resistance. This minimizes downtime and reduces maintenance frequency resulting in cost savings in high volume manufacturing.

- Customized Solutions:- Customers are looking for customized refractory solutions that meet their process requirements. Refractory manufacturers are responding by offering design and engineering support and post sales services to meet industrial needs.

- Cost Sensitivity and Total Cost of Ownership:- Although premium refractories cost more upfront, consumers are shifting focus to total cost of ownership rather than initial investment. Buyers are prioritizing products that improve overall plant efficiency and lower total cost of ownership over time.

- Environmental Awareness:- Consumers especially in developed markets are focusing on low carbon and recyclable refractories. Industries are under pressure to comply with environmental norms and this is impacting purchasing decisions.

Pricing Trends

Pricing of refractories is influenced by raw material availability, energy costs, logistics and manufacturing complexity. Prices can vary greatly depending on product type (basic, acidic or neutral refractories), form (shaped or unshaped) and application.

Magnesia and alumina based refractories are more expensive due to better thermal and corrosion resistance. Geopolitical tensions with key raw material suppliers like China and India can cause price volatility. But increasing adoption of recycled refractories is helping to stabilize prices in some regions.

Growth Factors

Several drivers are fueling the growth of the refractories market:

• Industrial Infrastructure Growth:- Manufacturing, energy and infrastructure growth – especially in developing economies – is creating huge demand for refractory materials. Asia-Pacific, Africa and Latin America is growing rapidly.

• Technology:- Innovations are leading to development of next gen refractories with better chemical stability, insulation and thermal performance. These innovations are enabling better productivity and cost efficiency in high temperature industrial operations.

• Environmental Regulations:- Stricter emission norms and energy efficiency regulations are forcing industries to adopt advanced refractories that support lower energy consumption and reduced emissions. Green refractories developed with low carbon footprint are gaining acceptance across multiple industries.

• Glass and Non-Ferrous Industries:- Growth in automotive and electronics industry is driving demand for glass and non-ferrous metals which in turn is increasing demand for specialized refractories that can withstand corrosive environment and high temperatures.

Regulatory Landscape

The refractories market is subject to stringent health, safety, and environmental regulations. These include:

• REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe mandates safety compliance for refractory raw materials.

• OSHA (Occupational Safety and Health Administration) in the U.S. requires safe handling and use of refractory products in industrial settings.

• ISO 9001 and ISO 14001 standards ensure that refractory manufacturing processes meet quality and environmental management guidelines.

• Many countries have emission limits and environmental standards for furnaces and kilns so advanced refractories are required.

Recent Developments

Recent developments in the refractories market include:

• Increased Adoption of Recycled Refractories: Leading players like RHI Magnesita and Imerys are investing heavily in recycling technologies to reclaim used refractory material. This aligns with circular economy and regulatory requirements.

• New Products: Companies are launching new products with higher thermal resistance and lower environmental impact. Ultra low cement castables and nano bonded refractories are becoming popular.

• Strategic Partnerships: Refractory manufacturers and end use industries are partnering to develop customised products. Recent examples are in steel and cement sectors to co-develop high performance solutions.

• Geographic Expansion: Big companies are setting up new production facilities and R&D centres in growth regions, especially Southeast Asia to serve local demand.

Current and Potential Growth Implications

Demand-Supply Analysis

Refractories demand is linked to industrial output, especially steel and cement production. While major economies are growing, supply constraints – especially in raw materials like bauxite, graphite and magnesia – can impact availability and price.

Gap Analysis

While the market is growing globally, there is a gap in high-performance, affordable refractories in developing countries. Technology transfer and local production is increasingly needed, especially in Africa and parts of Southeast Asia.

Top Companies in the Refractories Market

• RHI Magnesita

• Vesuvius plc

• Krosaki Harima Corporation

• HarbisonWalker International

• Morgan Advanced Materials

• Imerys

• Shinagawa Refractories Co., Ltd.

• Resco Products

• Refratechnik Group

• Calderys

Refractories Market: Report Snapshot

Segmentation | Details |

By Product Type | Shaped Refractories, Unshaped (Monolithic) Refractories |

By Material | Alumina, Silica, Magnesia, Zirconia, Carbon, Others |

By Application | Steel, Cement, Glass, Non-Ferrous Metals, Petrochemicals, Others |

By End-User | Iron & Steel Industry, Cement Industry, Glass Industry, Non-metallic Industry, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Refractories Market: High Growth Segments

• Monolithic Refractories:-This segment will grow as it is more efficient, easier to install and cost effective than shaped refractories.

• Magnesia-Based Refractories:- Excellent thermal resistance, magnesia-based refractories are in high demand in steelmaking and other high temperature applications.

Major Innovations

• Nano-Structured Refractories:- Incorporation of nano-materials has led to high-performance refractories with improved thermal shock resistance and longer life.

• Eco-Friendly Refractories:- Innovations include low-cement castables and non-toxic binders to reduce emissions and improve recyclability.

Refractories Market: Potential Growth Opportunities

• Expansion into Emerging Economies:-Emerging markets in Asia-Pacific, Africa and Latin America offer huge opportunities due to infrastructure growth and industrial expansion.

• Integration with Smart Manufacturing:-Integration of smart sensors and digital monitoring systems in refractory-lined equipment offers predictive maintenance and process optimization, new growth avenues.

Extrapolate Research says:

The global refractories market is growing fast, driven by industrialization, steel and cement demand and focus on energy efficient and sustainable manufacturing. As technology improves product performance and life, refractory solutions are becoming essential in high temperature industrial sectors.

With monolithic and eco-friendly refractory on the rise, driven by regulation and innovation, the market will continue to grow. Companies that invest in R&D, partnerships and emerging markets will be well positioned to meet industry needs. According to Extrapolate Research, this market will be key to the future of sustainable industrial infrastructure and high efficiency production systems.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Refractories Market Size

- June-2025

- 140

- Global

- Chemicals-and-Advanced-Materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021