Diesel Exhaust Fluid Market Size, Share, Growth & Industry Analysis, By Application (On-Road Vehicles, Off-Road Vehicles, Non-Road Machinery, Rail & Marine, Others) By End-User (Commercial Vehicle Operators, Fleet Owners, Individual Vehicle Owners, Industrial Equipment Operators) By Formulation Type (AUS 32 (32.5% Urea Solution), Others) By Distribution Channel (Retail Pumps, Bulk Supply, Packaged Sales (jugs, totes, drums)), and Regional Analysis, 2024-2031

Diesel Exhaust Fluid Market: Global Share and Growth Trajectory

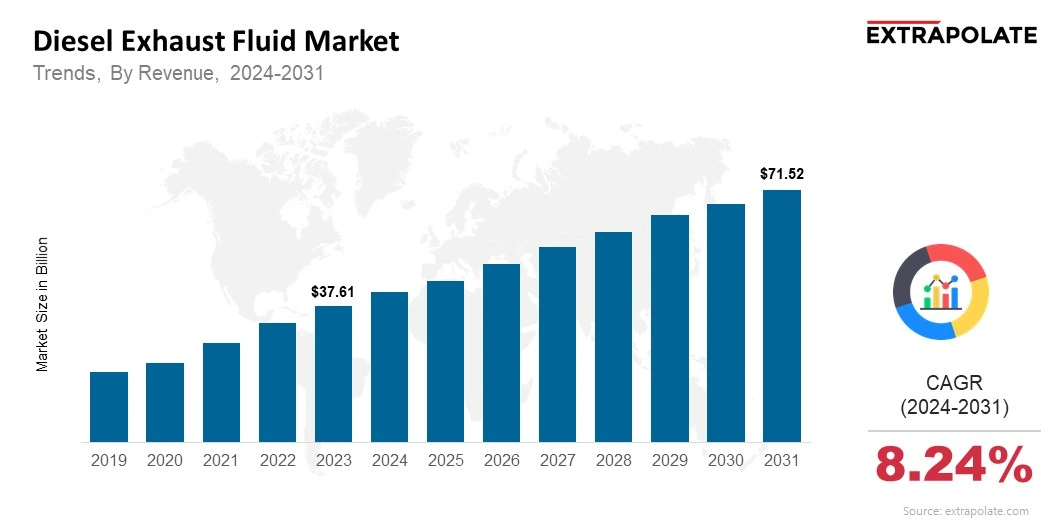

Global Diesel Exhaust Fluid Market size was recorded at USD 37.61 billion in 2023, which is estimated to be valued at USD 41.06 billion in 2024 and reach USD 71.52 billion by 2031, growing at a CAGR of 8.24% during the forecast period.

The global diesel exhaust fluid (DEF) market is growing steadily and strongly driven by emissions regulations and environmental awareness. DEF is a critical component in selective catalytic reduction (SCR) systems and plays a major role in reducing NOx emissions from diesel engines. As governments and regulatory bodies around the world crack down on vehicle emissions, DEF adoption has grown and is now a key part of the automotive and industrial sectors.

Demand is further driven by the increasing sales of heavy duty and commercial vehicles that use SCR technology to meet emissions standards like Euro 6, EPA 2010 and China VI. As developing countries implement stricter emissions rules and existing fleets retrofit with SCR systems, DEF consumption will continue to rise. And with the expansion of DEF distribution networks – retail pumps and bulk delivery solutions – DEF is now more accessible and affordable for fleet operators and individual vehicle owners.

Non-road machinery like construction, agricultural and mining equipment are also adopting SCR systems and expanding the market. With sustainability goals becoming more urgent across industries, DEF’s role in supporting clean diesel is undeniable. Players are investing in production capacity, distribution infrastructure and quality control systems to meet the growing demand and comply with regulations, making DEF a vital environmental solution in the global transport and machinery sectors.

Key Market Trends Driving Product Adoption

Several trends are fueling the adoption of diesel exhaust fluid across the globe:

Emissions Regulations: Governments around the world are cracking down on emissions to combat air pollution and climate change. Regulations like Euro 6 in Europe, Bharat Stage VI in India and EPA Tier 4 in the US are demanding lower NOx emissions from diesel engines. SCR systems with DEF are the industry’s go-to solution to meet these standards and that’s why DEF is being adopted widely.

Commercial Vehicle Sales Growth: Urbanization, e-commerce and infrastructure development are driving demand for heavy duty trucks and buses. These vehicles rely heavily on SCR technology to meet emissions norms. As commercial vehicle fleets grow in emerging markets, DEF consumption is growing along with it.

Non-Road SCR Applications Growth: Emissions regulations now cover non-road mobile machinery like construction equipment, agricultural tractors and mining trucks. As manufacturers equip these machines with SCR systems, the demand for DEF in off-road segments is growing rapidly and diversifying the customer base.

Improved Distribution Infrastructure: DEF was earlier available only in bulk containers but now it’s increasingly available through dedicated retail pumps, service stations and even packaged formats in supermarkets. This ease of availability is reducing operational barriers and encouraging consistent DEF use among fleet operators and individual drivers alike.

Rising Environmental Awareness: Corporate sustainability commitments and government initiatives to reduce pollution are driving demand for cleaner technologies. DEF enables diesel engines to meet tough environmental standards without sacrificing power or efficiency and is an essential part of “greener” transportation strategies.

SCR System Innovations: Vehicle manufacturers are developing more advanced SCR systems that require precise DEF dosing for optimal performance. This trend is driving demand for high quality DEF and specialty formulations that meet ISO 22241 standards to ensure consistency and performance.

Major Players and their Competitive Positioning

The diesel exhaust fluid market is highly competitive, with major players investing in production capacity, distribution networks, and branding to strengthen their market share. Key participants include: Yara International ASA, CF Industries Holdings, Inc., BASF SE, TotalEnergies SE, Royal Dutch Shell plc, Cummins Inc., Mitsui Chemicals, Inc., Air Liquide S.A., Old World Industries, LLC, Nutrien Ltd.

These companies compete on several fronts, including production scale, distribution reach, quality assurance, and pricing strategies. Many have vertically integrated operations, controlling production from urea sourcing to final packaging and distribution. Strategic partnerships with fuel retailers, logistics providers, and vehicle manufacturers further consolidate their market positioning.

In addition to these global leaders, regional producers and distributors serve local markets with tailored solutions. Market players frequently invest in expanding production plants, developing advanced packaging solutions, and improving logistics efficiency to reduce costs and improve service. Mergers, acquisitions, and joint ventures also shape the competitive landscape, enabling companies to expand their geographic footprint and technological capabilities.

In March 2024, Liqui Moly introduced the Crystal Clean DEF additive concentrate. Designed to enhance SCR system performance, the additive prevents urea crystal formation, lowers freezing point to –16 °C, and helps maintain clean injection systems, improving engine reliability and emission compliance.

In April 2024, Western Global launched its new 2,000‑litre 22 DEF bulk storage tank. The large-capacity, ISO 22241-compliant tank reduces labor costs and increases operational efficiency by streamlining onsite DEF storage and dispensing.

Consumer Behavior Analysis

Consumer behavior in the diesel exhaust fluid market is influenced by:

Regulatory Compliance: Compliance with emissions standards is the main driver of DEF consumption. Vehicle owners and fleet operators need to use DEF to ensure their SCR equipped vehicles meet the legal requirements and avoid penalties.

Cost: While DEF is an operational expense, it’s a small cost compared to the cost of non-compliance or reduced engine performance. Fleet managers look for competitive pricing and may negotiate bulk supply agreements to manage costs.

Convenience and Accessibility: Wide availability of DEF at fuel stations, service centers and retail outlets has changed user behavior. Easy access reduces the risk of supply disruptions that can sideline vehicles.

Brand and Quality: Vehicle manufacturers and operators prioritize DEF that meets ISO 22241 standards to prevent system damage. Brand reputation, quality assurance and certifications influence buying decisions as off-spec DEF can cause costly repairs.

Education and Awareness: As SCR systems become more common in vehicles, users are more aware of the importance of DEF quality, proper storage and correct dosing. Manufacturers and distributors invest in education campaigns to ensure customers understand these requirements.

Pricing Trends

DEF pricing is influenced by urea feedstock costs, production process, transportation costs and local market competition. Historically prices have been stable but can fluctuate with global urea prices, energy costs and supply-demand dynamics.

High quality DEF must meet strict purity requirements to protect SCR systems. This necessity drives investment in production technology which can impact costs. Bulk buyers negotiate lower per liter prices while retail packaging and small volume sales command a premium due to distribution and packaging costs.

In mature markets like North America and Europe price competition has increased as distribution infrastructure improves and more players enter the market. This benefits end users with more choices and better pricing transparency. In emerging markets pricing can remain high due to limited local production capacity and logistical challenges.

Overall while DEF is an operational cost for fleet operators the long term benefits of regulatory compliance, reduced engine maintenance and avoiding emissions penalties make the cost justifiable and relatively inelastic.

Growth Factors

Several things are driving long term growth in the diesel exhaust fluid market:

Global Emissions Standards: Worldwide implementation of tougher emissions regulations means SCR systems on diesel engines. These are moving beyond on-road vehicles to off-road sectors, driving DEF demand.

Commercial Transport Growth: Global e-commerce, trade and infrastructure development means more heavy-duty trucks and buses that use SCR systems, and therefore DEF.

Non-Road Machinery Adoption: Emissions regulations are tightening for construction, agricultural and mining equipment, so DEF use in these sectors is growing, opening up new markets for suppliers.

Expanding Distribution Networks: Investment in retail pumps, bulk delivery solutions and convenient packaging formats means DEF is more accessible to the consumer, reducing supply barriers.

Environmental Awareness: Growing societal and corporate focus on sustainability means adoption of cleaner diesel technologies, including SCR systems that use DEF.

Technical Innovation: SCR systems require precise DEF dosing and high quality formulations, so demand for compliant, pure DEF that meets international standards.

Emerging Market Growth: Developing regions are introducing stricter emissions regulations and modernising their fleets, big growth opportunities for DEF suppliers.

Regulatory Landscape

The diesel exhaust fluid market is driven by environmental regulations that require reduced NOx emissions:

- Europe: Euro 6 standards require advanced emissions control systems on new diesel vehicles, so SCR systems—and thus DEF—must be used to comply.

- United States: EPA 2010 standards introduced tough NOx limits, so SCR technology is required on heavy-duty vehicles. Non-road Tier 4 regulations drive DEF use in construction and agricultural equipment.

- China: China VI standards, based on Euro 6, enforce tight NOx limits for trucks and buses. Enforcement has increased in recent years, boosting DEF demand.

- India: Bharat Stage VI regulations went into effect nationwide in 2020, requiring SCR systems on many diesel vehicles to reduce emissions.

- ISO 22241: This standard governs DEF quality, specifying composition, purity and handling requirements to protect SCR systems and ensure performance. Compliance depends on using DEF that meets these specs.

Regulations worldwide are getting tighter and tighter, so DEF demand is here to stay as industries meet environmental targets.

Recent Developments

The diesel exhaust fluid market has seen some big developments and highlights recently:

Capacity Expansion: Yara International, CF Industries and BASF have invested in expanding DEF production capacity to meet global demand. This helps to stabilize supply and improve regional availability, reducing transportation costs and emissions.

Distribution Networks: Fuel retailers and logistics providers are expanding DEF retail pump networks in North America, Europe and emerging markets. Service stations are now offering DEF alongside diesel fuel, making it easier for commercial fleets and individual drivers to refuel.

Packaging Innovation: DEF producers are introducing convenient packaging formats like jugs, totes and drums that meet ISO 22241 specs. These are aimed at small fleet operators and retail customers who need flexible, easy to store solutions.

Partnerships: Companies are forming alliances to strengthen distribution networks and ensure supply. For example, partnerships between producers and fuel station chains are expanding retail availability, while partnerships with vehicle OEMs are providing customers with clear guidance on DEF use and quality requirements.

Emerging Markets: With enforcement increasing in regions like India, China and Latin America, DEF demand is growing beyond North America and Europe. Local production facilities are being set up to serve these new markets cost effectively.

Emphasis on Quality: Off-spec DEF can damage SCR systems so quality control is key. Producers and distributors are investing in certification, testing and customer education to ensure supply is consistent and compliant.

Current and Potential Growth Implications

Demand-Supply Analysis: The global DEF market is growing fast due to increasing vehicle fleets, tighter emissions regulations and growing environmental awareness. Producers are building new plants and optimizing supply chains to meet demand reliably and cost effectively.

Supply Challenges: While global capacity is increasing, some regions face supply shortages due to limited local production, logistical issues or delayed infrastructure development. This can lead to price volatility and supply insecurity, especially in emerging markets.

Gap Analysis: Despite growth, there are gaps in distribution coverage, especially in rural and remote areas. Companies are investing in retail pump networks, bulk delivery systems and packaging solutions to fill these gaps and make DEF more accessible.

Opportunities in Non-Road Segments: Emissions regulations are extending to off-road machinery. This creates big opportunities in construction, agriculture and mining sectors where SCR is being adopted fast and DEF demand is growing.

Environmental and Sustainability Implications: The growth of DEF supports global emissions reduction targets by enabling diesel engines to meet strict NOx limits. As more industries adopt SCR, DEF becomes more critical to cleaner air and climate change mitigation.

Top Companies in the Diesel Exhaust Fluid Market

- Yara International ASA

- CF Industries Holdings, Inc.

- BASF SE

- TotalEnergies SE

- Royal Dutch Shell plc

- Cummins Inc.

- Mitsui Chemicals, Inc.

- Air Liquide S.A.

- Old World Industries, LLC

- Nutrien Ltd.

Diesel Exhaust Fluid Market: Report Snapshot

Segmentation | Details |

By Application | On-Road Vehicles, Off-Road Vehicles, Non-Road Machinery, Rail & Marine, Others |

By End-User | Commercial Vehicle Operators, Fleet Owners, Individual Vehicle Owners, Industrial Equipment Operators |

By Formulation Type | AUS 32 (32.5% Urea Solution), Others |

By Distribution Channel | Retail Pumps, Bulk Supply, Packaged Sales (jugs, totes, drums) |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Diesel Exhaust Fluid Market: High-Growth Segments

These segments will see high growth in the diesel exhaust fluid market:

On-Road Vehicles: As commercial truck and bus fleets grow globally, on-road is the largest and most active segment. Regulations will keep driving adoption.

Off-Road Machinery: Construction, agriculture and mining are adopting SCR to meet emissions rules. This is a big growth opportunity for DEF suppliers.

Retail Pump Distribution: Investing in dedicated DEF pumps at fuel stations makes refueling easy and regular, driving growth in retail.

Packaged Sales: Small operators and individual vehicle owners prefer packaged formats, which are convenient and meet quality standards. This segment is growing in regions with developing distribution infrastructure.

Major Innovations

Innovation in the diesel exhaust fluid market includes:

Advanced Production Technologies: Producers are investing in high-purity production processes to ensure ISO 22241 compliance, minimize contamination risks.

Convenient Packaging: Companies are developing user-friendly packaging like easy-pour jugs, recyclable containers and spill-resistant designs to improve safety and reduce waste.

Retail Pump Infrastructure: Fuel stations worldwide are installing DEF pumps alongside diesel dispensers, making it easy for commercial fleets and reducing refueling time.

Digital Supply Chain: Producers and distributors are adopting advanced logistics to track inventory, optimize delivery routes and ensure on-time DEF supply to customers.

Quality Assurance Programs: Testing, certification schemes and consumer education initiatives to eliminate off-spec DEF from the market, protect vehicle SCR systems and ensure regulatory compliance.

Diesel Exhaust Fluid Market: Potential Growth Opportunities

Growth opportunities in the diesel exhaust fluid market:

Emerging Markets: As emissions standards tighten in Asia, Africa and Latin America, DEF demand will skyrocket. Companies that get in early with local production and distribution will be first to market.

Non-Road and Industrial: Beyond on-road vehicles, DEF use in construction, agriculture, mining and stationary power applications is a huge untapped market as emissions regulations broaden.

OEM and Fuel Retailer Partnerships: Partner with vehicle manufacturers and fuel station chains to secure long term distribution channels, brand recognition and compliant DEF supply.

Innovation in Packaging and Logistics: Develop cost effective, environmentally friendly and easy to use packaging solutions and optimize logistics to reduce delivery costs.

Education and Awareness: Invest in customer education on DEF quality, storage and handling to drive adoption and loyalty among fleet operators and individual users.

Extrapolate Research says:

The diesel exhaust fluid market is set to grow strongly over the next few years. With global emissions regulations tightening, SCR equipped vehicles on the rise and off-road machinery applications expanding, DEF is now an essential part of the drive for cleaner air.

As distribution networks improve, production capacity increases and environmental awareness grows, demand for high quality compliant DEF will only get stronger. Market leaders are investing in innovation, partnerships and logistics to serve this growing need, while emerging markets offer big new opportunities.

Overall DEF is the practical proven solution for cleaner diesel operations – a solution that supports global environmental goals and the continued viability of diesel powered transport and machinery. The market outlook is very positive with sustainability at its heart.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Diesel Exhaust Fluid Market Size

- July-2025

- 148

- Global

- Chemicals-and-Advanced-Materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021