Aqueous Polyurethane Dispersion (PU) Market Size, Share, Growth & Industry Analysis, By Product Type (One-component, Two-component, Urethane-modified dispersions) By Application (Coatings, Adhesives, Sealants, Textiles, Leather, Others) By End-User (Automotive, Construction, Furniture, Packaging, Textiles, Others), and Regional Analysis, 2024-2031

Aqueous Polyurethane Dispersion (PU) Market Global Share and Growth Trajectory

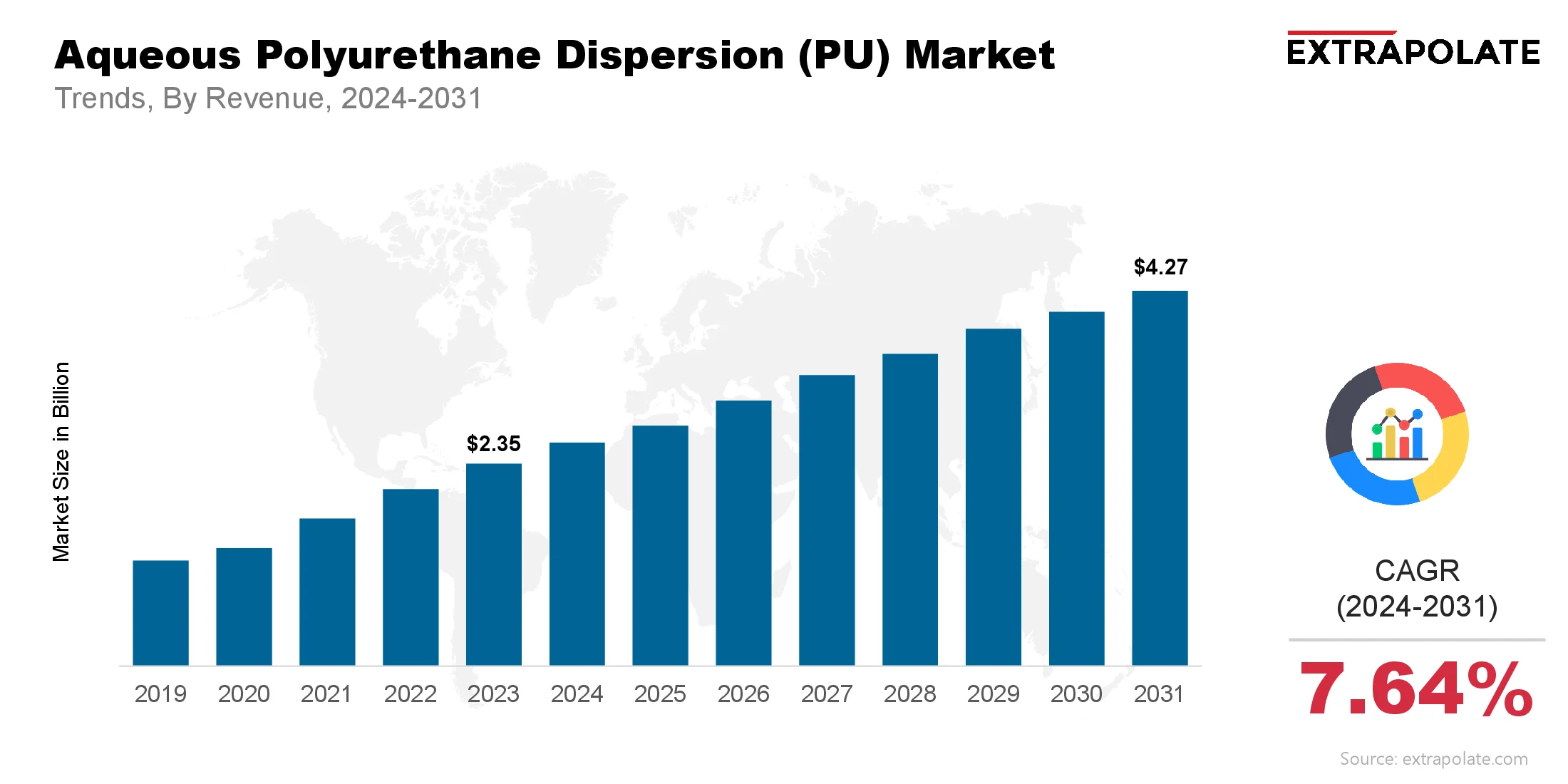

The global Aqueous Polyurethane Dispersion (PU) Market size was valued at USD 2.35 billion in 2023 and is projected to grow from USD 2.55 billion in 2024 to USD 4.27 billion by 2031, exhibiting a CAGR of 7.64% during the forecast period.

The Aqueous Polyurethane Dispersion (PU) Market is steadily ascending as demand for eco-friendly, low-emission coatings and adhesives gains global momentum. Aqueous PU dispersions are water-based systems widely used in coatings, adhesives, sealants, and elastomers (CASE) applications. Their environmental compatibility, low volatile organic compound (VOC) content, and outstanding film-forming properties make them a preferred alternative to solvent-based systems.

As regulatory agencies across North America, Europe, and Asia tighten environmental compliance laws, manufacturers are increasingly turning to aqueous polyurethane dispersions to meet sustainability goals. This trend is accelerated by rising demand in key end-use sectors such as automotive, furniture, construction, packaging, and textiles. With evolving consumer preferences favoring environmentally responsible materials and the industry’s inclination toward safer, high-performance chemical formulations, the aqueous PU dispersion market is poised for continued expansion in the years ahead.

Key innovations such as self-healing coatings, enhanced water resistance, and the use of renewable raw materials are pushing the technological envelope. As such advancements enter mainstream production, the market is expected to witness a significant transformation, leading to enhanced application versatility and expanded adoption in newer sectors.

Key Market Trends Driving Product Adoption

Shift Toward Sustainable Coating Solutions

Growing environmental consciousness is reshaping material selection across industries. Manufacturers are reducing dependency on solvent-based polymers due to their high VOC emissions and regulatory constraints. Aqueous polyurethane dispersions offer a non-toxic, low-emission alternative that complies with REACH and other international green standards. The shift toward sustainability is propelling the adoption of aqueous PU dispersions across coatings and adhesives, particularly in indoor environments like furniture and flooring.

Rising Demand from the Automotive and Construction Industries

The automotive industry utilizes aqueous PU dispersions for high-performance coatings that offer abrasion resistance, flexibility, and aesthetic appeal. Similarly, the construction sector favors these dispersions for waterproofing membranes, sealants, and surface coatings. The growth in infrastructure development and automotive production—particularly in Asia-Pacific—has fueled product demand, making these two industries dominant consumers.

Technological Advancements in Dispersion Chemistry

Continuous innovation in polymerization techniques has led to the development of dispersions with improved thermal stability, water resistance, elasticity, and adhesion to varied substrates. Novel hybrids and nano-dispersions are extending the range of applications from general coatings to smart textiles and biocompatible medical devices. These developments are encouraging further integration of aqueous PU dispersions into industrial manufacturing processes.

Increased Consumer Awareness of Indoor Air Quality

Consumers are increasingly concerned about indoor air quality, especially post-pandemic. Products that emit fewer toxins are becoming more desirable. Aqueous PU dispersions, with minimal or zero VOC emissions, address this concern directly. As awareness grows, so does the demand for safe, non-toxic coatings for residential and commercial interiors. Covestro AG, BASF SE, Huntsman Corporation, Lubrizol Corporation, DSM, Mitsui Chemicals, Allnex, Alberdingk Boley GmbH, Stahl Holdings B.V., and DIC Corporation.

Consumer Behavior Analysis

- Rising Preference for Green Products: End-users in the industrial and consumer sectors are making more informed decisions regarding sustainability and environmental impact. A growing segment of consumers now demands products made with greener raw materials. This has a direct influence on OEMs and formulators, prompting them to adopt water-based polyurethane systems in manufacturing.

- Cost-Performance Balance: Although aqueous PU dispersions tend to be costlier than some traditional solvent-based options, the benefits they offer in terms of safety, regulatory compliance, and performance often justify the cost. Manufacturers are more willing to invest in high-performing formulations that reduce long-term environmental and health liabilities.

- Customization and Application-Specific Demand: Buyers increasingly seek customized PU dispersions tailored to specific applications—be it for flexibility in textile coatings, toughness in automotive applications, or gloss in wood finishes. This growing demand for performance-specific solutions is encouraging manufacturers to offer greater customization and technical support.

- Demand for Transparency and Certifications: Buyers in North America and Europe place a high value on transparency. Certifications such as GreenGuard, EcoLabel, and Blue Angel are becoming prerequisites for purchasing decisions. Companies able to provide verified low-emission and bio-based certifications for their products have a significant market advantage.

Pricing Trends

Multiple elements shape pricing in this market. Material availability, tech capability, local rules, and demand shifts are critical. Key inputs like polyols and isocyanates rely on petroleum. Changes in oil prices can influence overall production costs.

These dispersions are eco-friendly but expensive. Scarce raw materials and specialized methods drive up the price. Production advancements and scaling are underway. These factors are steadily narrowing the price difference between bio-based and synthetic alternatives.

Major buyers secure long-term supply agreements. This helps them access discounts for high-volume purchases. Companies are adopting private-label strategies. This helps control pricing and ensure product availability.

Growth Factors

Environmental Regulations

Strict environmental rules are driving change. REACH in Europe and EPA mandates in the U.S. push the move to waterborne systems. Aqueous PU dispersions support regulatory compliance. They offer strong performance with minimal environmental impact.

Innovation in Raw Materials

The supply of renewable materials is increasing. These include castor oil, soy, and palm oil, aiding innovation in PU dispersions. Environmental benefits are a key outcome of these advances. They also deliver improved UV stability, flexibility, and bonding.

Expanding End-Use Industries

Expansion in industries like construction and automotive is notable. It increases the need for high-quality dispersions. Aqueous PU dispersions benefit from market shifts. Growth in flexible packaging and synthetic leather drives this demand.

Rise of Functional and Smart Coatings

PU dispersion technology has advanced significantly. It now enables features like self-healing, flame retardancy, and anti-microbial effects. These advanced coatings are used in key sectors like healthcare and electronics. They open new paths for market expansion.

In July 2025, Lubrizol introduced Sancure 942, a cutting-edge water‑borne, high.‑solids polyurethane dispersion (PUD) engineered for high‑performance wood coatings. It delivers enhanced wear resistance, strong chemical durability, superior substrate adhesion, and improved coverage efficiency enabling fewer coats, faster return to service, and reduced emissions when paired with external crosslinkers.

Regulatory Landscape

Health, safety, and environmental standards guide the market. Global regulations play a key role in this shift. All materials must undergo extensive testing. Approval is necessary before use in consumer or industrial products.

- REACH (EU): The regulation enforces chemical registration. PU dispersions and other substances must undergo safety evaluation.

- EPA (USA): VOC emissions are regulated under the Clean Air Act. Coating products must comply with these limits.

- ISO Standards: Standards help ensure quality in production. ISO 14001 focuses on managing environmental impacts.

- GHS (Globally Harmonized System): It provides clear classification and labeling standards. These ensure safe handling and proper use of materials.

Compliance with these standards is mandatory. It is essential for market entry and customer trust in regulated sectors.

Recent Developments

- Eco-Friendly Innovation: New PU dispersions by BASF and Covestro feature renewable materials. They are designed for packaging and textile use. These actions reflect a broader trend. The industry is advancing toward sustainable solutions.

- Strategic Expansions: To meet rising demand, Lubrizol scaled up operations in Asia-Pacific. Allnex is enhancing R&D in hybrid PU dispersion technologies.

- Collaborations: Top firms are working with academic and research bodies. They focus on creating dispersions that offer multi-functional performance.

These findings illustrate ongoing innovation. They also point to clear strategic trends in the market.

Current and Potential Growth Implications

a. Demand-Supply Analysis

Supply chains are becoming more advanced. Leading producers are building local hubs for faster delivery and lower costs. Capacity limits in bio-based raw materials remain a concern. Uneven regulatory enforcement across regions adds to the challenge.

b. Gap Analysis

Advanced economies adopt quickly. Developing nations face barriers due to expense and limited knowledge. There is limited access to tailored dispersions. This is a concern in tropical regions and basic production setups. Bridging this gap offers major potential. It can greatly expand market reach.

Top Companies in the Aqueous Polyurethane Dispersion Market

- Covestro AG

- BASF SE

- Huntsman Corporation

- Lubrizol Corporation

- DSM

- Mitsui Chemicals

- Allnex

- Alberdingk Boley GmbH

- Stahl Holdings B.V.

- DIC Corporation

Aqueous Polyurethane Dispersion Market: Report Snapshot

Segmentation | Details |

By Product Type | One-component, Two-component, Urethane-modified dispersions |

By Application | Coatings, Adhesives, Sealants, Textiles, Leather, Others |

By End-User | Automotive, Construction, Furniture, Packaging, Textiles, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Aqueous Polyurethane Dispersion Market: High Growth Segments

- One-Component Dispersions: The material is easy to apply. This benefits industrial coating and adhesive processes.

- Textiles and Leather Applications: There is strong demand for flexible and durable finishes. Additionally, eco-friendly features support market expansion.

- Asia-Pacific Region: The market expands due to industrial development. Supportive regulatory frameworks and rising local demand are key factors.

Major Innovations

- Renewable Polyol Integration: The process creates eco-friendly products. These products break down naturally.

- Hybrid PU Dispersions: Enhanced performance is achieved by blending polycarbonate and polyester. This improves the material’s strength.

- Nano-Technology Infusion: Coatings have smart self-cleaning functions. They provide antimicrobial effects.

Aqueous Polyurethane Dispersion Market: Potential Growth Opportunities

- Expansion into Emerging Markets: Producing locally benefits areas including Southeast Asia and South America. It leads to lower costs and better access. It helps lower expenses and increase product availability.

- Customized Solutions for Niche Applications: Industries including sportswear, electronics, and biomedical devices are targeted. They offer promising opportunities for innovation.

- Strategic Collaborations for R&D: Organizations engage with universities and research centers. Their aim is to deliver innovative responses to future issues.

Extrapolate says:

Aqueous PU dispersions are gaining traction. The shift to sustainable, high-grade materials drives this rise. As rules get strict and air quality matters more, Aqueous PU use is rising. It is now vital in coatings and adhesives.

With new tech and growing demand, the market is expanding. Consumer interest adds to the rise. Firms that invest in R&D gain an edge. Expanding capacity also brings key gains. Customization and sustainability now guide purchasing trends. Aqueous PU dispersions lead in advanced material solutions.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Aqueous Polyurethane Dispersion

- July-2025

- ��� ���1���4���0

- Global

- Chemicals-and-Advanced-Materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021