Biofuels Market Size, Share, Growth & Industry Analysis, By Form (Solid, liquid, Gaseuos), By Fuel Type (Ethanol, Biodiesel, Renewable Diesel, Biojet Fuels, Others), and Regional Analysis, 2024-2031

Biofuels Market Size

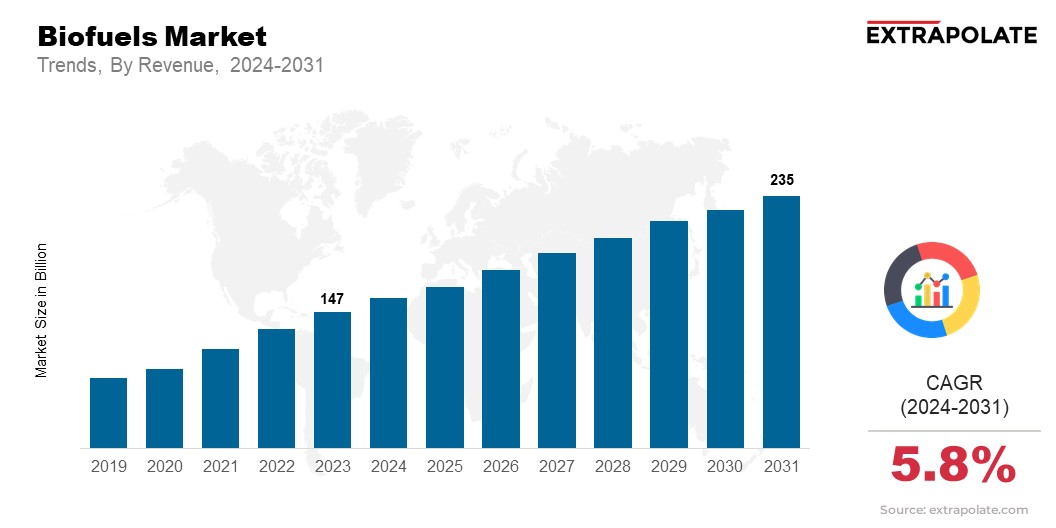

The global Biofuels Market size was valued at USD 147 billion in 2023 and is projected to reach USD 235 billion by 2031, exhibiting a CAGR of 5.8% driven by the increasing need for sustainable energy solutions and the growing emphasis on reducing carbon emissions. Governments worldwide are promoting renewable energy, including biofuels, to address climate change. They are using policies and incentives to encourage its adoption.

Biofuels are sourced from renewable organic materials. They are key to a sustainable energy future. Liquid biofuels, like ethanol and biodiesel, dominate the market. They are increasingly used as blends with conventional fuels in transportation. The rise in biojet fuel use in aviation is boosting the market.

Airlines seek to cut their carbon footprint. Also, advances in biofuel production are fostering market expansion. This is due to better feedstock and new advanced biofuels. The biofuels market is set to witness robust growth due to supportive regulatory frameworks. This growth is further propelled by ongoing investments.

Biofuels Market Trends

Three major trends are currently shaping the biofuels market. There is a strong emphasis on decarbonization and energy transition policies globally. Governments are setting ambitious targets to cut carbon emissions. They are promoting biofuels as a viable alternative to fossil fuels. This has led to mandates and subsidies, especially for ethanol and biodiesel. They are now widely adopted in many sectors.

In addition, the development and commercialization of advanced biofuels are gaining prominence. Unlike first-generation biofuels, advanced biofuels are made from non-food biomass like agricultural waste. This addresses concerns about food security and land use. This shift is vital for sectors like aviation. Biojet fuels are now key to sustainable operations.

Furthermore, technological innovations are reshaping the biofuels dynamics. Genetic engineering of feedstock and better biorefining are increasing efficiency and cutting costs. Biofuels are now more competitive with traditional energy sources. This is speeding up their market adoption.

Biofuels Market Growth Factors

Numerous factors are fostering the development of the biofuels market. A key growth driver is government policies to cut greenhouse gas emissions. Countries are adopting blending mandates, subsidies, and tax breaks to promote biofuels adoption. These rules are strong in North America and Europe. Biofuels are key to meeting carbon reduction targets in these regions.

Another significant growth factor is the rising demand for energy security. Due to geopolitical uncertainties and rising fossil fuel prices, many countries are turning to biofuels. They aim to reduce their reliance on imported oil. This is especially relevant in transportation. Liquid biofuels are a stable, renewable energy source.

Furthermore, new feedstock tech and biorefining processes are improving biofuel production. They are making it more efficient and scalable. Innovations like algae-based biofuels and using agricultural waste are broadening feedstock options. They make biofuel production more sustainable and cost-effective. The demand for cleaner aviation solutions is rising. Biojet fuels are a key alternative to reduce air travel's carbon emissions.

Segmentation Analysis

The biofuels market is divided into segments based on form and fuel type, each offering unique benefits and applications across various industries.

By Form

Biofuels can be segmented into solid, liquid, and gaseous forms, each playing a crucial role in the market. Solid biofuels, including wood pellets and agricultural waste, are mainly used for power generation and heating. These fuels are preferred for their renewability and use of waste. They are an eco-friendly energy source.

Liquid biofuels, like ethanol and biodiesel, are the most used. This is especially true in the transportation sector. They are direct substitutes for gasoline and diesel. They are a cleaner, low-emission alternative. Gaseous biofuels, like biogas and biomethane, are gaining popularity. They are versatile and can be used for electricity generation and transportation. These fuels are made from organic waste. They are a sustainable energy source and help manage waste.

By Fuel Type

The biofuels market is further divided by fuel type. Among them, ethanol is the most prominent. Ethanol is mainly used as a gasoline additive. It reduces emissions and boosts fuel quality. Biodiesel, another key segment, is widely used in diesel engines. It is a renewable alternative that reduces reliance on fossil fuels.

Renewable diesel is similar to petroleum diesel. It is made from renewable sources and works with existing infrastructure, highly favored option for fleet operators. Biojet fuels are vital to aviation. They meet the need for sustainable air travel. These fuels are essential for reducing the carbon footprint of the aviation sector. The others category includes advanced biofuels in development. They aim to provide more efficient, sustainable energy solutions.

Biofuels Market Regional Analysis

The biofuels market has varied growth across regions. Each region is driven by its own regulations and market forces. North America is a key region, especially the U.S. It leads in ethanol production and use. The U.S. Renewable Fuel Standard (RFS) mandates biofuel blending with traditional fuels.

Moreover, advances in corn and soybean biofuels have strengthened the dominance. Canada is working to expand its biofuels market. It has aggressive carbon reduction targets and government incentives to support this.

In Europe, the market is driven by stringent environmental regulations and a strong focus on renewable energy. The EU's Renewable Energy Directive (RED II) aims for high biofuel use in transport. It has boosted the use of biodiesel and advanced biofuels. Germany, France, and the Netherlands are leading efforts to boost biofuel production. They aim to ensure sustainability through certified supply chains.

In the Asia-Pacific, the biofuels market is booming. China, India, and Indonesia are leading the growth. These nations are investing in biofuels. They seeks to meet rising energy demands and reduce reliance on imported fossil fuels. India aims for a 20% ethanol blend in gasoline by 2025. This has spurred major investments in ethanol production facilities. Meanwhile, Indonesia is a major biodiesel producer. It uses palm oil as feedstock, supported by government mandates.

Latin America, especially Brazil, is a key region for biofuels, with ethanol playing a pivotal role in the country’s energy matrix. Brazil's vast sugarcane industry fuels its ethanol production. It makes Brazil a leader in biofuels. The Middle East and Africa are emerging markets. They are showing a growing interest in biofuels as part of renewable energy plans.

Competitive Landscape

The biofuels market is highly competitive, with major players focusing on innovation, strategic partnerships, and capacity expansions to strengthen their positions. Key companies such as Archer Daniels Midland Company (ADM), Renewable Energy Group (REG), and Neste Corporation are leading the market through continuous investments in research and development. These companies are also exploring advanced biofuels and expanding their production capabilities to meet growing demand.

Strategic collaborations, such as partnerships with airlines for biojet fuel supply and joint ventures for advanced biorefineries, are common strategies to enhance market reach. Additionally, regional players are increasingly focusing on scaling up production and improving the sustainability of their feedstock sourcing, further intensifying competition.

List of Key Players in Biofuels Market

- Diester Industries

- Glencore,Infinita Renovables

- Neste Oil Rotterdam

- Ital Green Oil

- ADM

- Renewable Energy Group

- Cargill

- Biopetrol

- Louis Dreyfus

- Evergreen Bio Fuels

Key Industry Developments

In 2024, Neste Corporation announced plans to expand its renewable diesel production capacity by 1.2 million tons annually in a new facility in Singapore. This move is set to solidify Neste’s position as a global leader in renewable fuels.

Archer Daniels Midland (ADM) recently invested $350 million in expanding its ethanol production facilities in the U.S., focusing on enhancing the efficiency of its corn-based ethanol production processes. This expansion aims to support the growing demand for ethanol blending.

Renewable Energy Group (REG) has entered into a partnership with Chevron to co-develop renewable diesel production facilities. This collaboration highlights the growing interest of major oil companies in biofuels as part of their energy transition strategies.

These developments underscore the dynamic nature of the biofuels market, where companies are making significant investments and forming strategic alliances to capitalize on growing demand and regulatory support.

The global Biofuels Market is segmented as:

By Form

- Solid

- liquid

- Gaseuos

By Fuel Type

- Ethanol

- Biodiesel

- Renewable Diesel

- Biojet Fuels

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- South Africa

- North America

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Biofuels Market Size

- October-2024

- 149

- Global

- Chemicals-and-Advanced-Materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021