OLEDoS Market Size, Share, Growth & Industry Analysis, By Product Type (Microdisplays, Full-Color Displays, Monochrome Displays), By Application (Augmented Reality, Virtual Reality, Medical Imaging, Defense Systems, Industrial Wearables), By End-User (Consumer Electronics, Healthcare, Military & Defense, Industrial, Automotive), and Regional Analysis, 2024-2031

OLEDoS Market: Global Share and Growth Trajectory

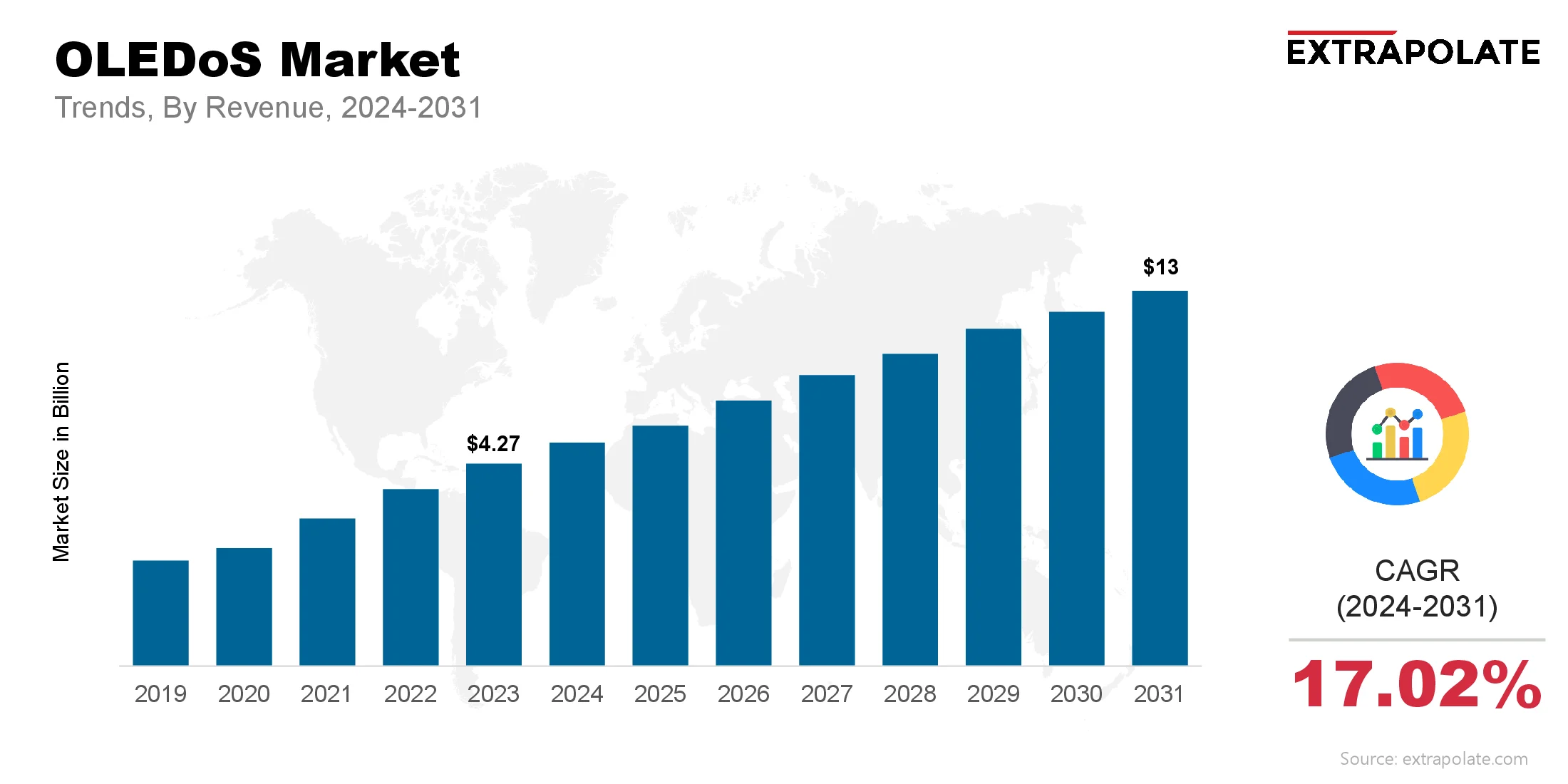

The global OLEDoS Market size was valued at USD 4.27 billion in 2023 and is projected to grow from USD 4.32 billion in 2024 to USD 13 billion by 2031, exhibiting a CAGR of 17.02% during the forecast period.

The Organic Light-Emitting Diode on Silicon (OLEDoS) market is growing fast driven by the demand for ultra-high resolution displays across consumer and industrial applications. OLEDoS technology combining the benefits of OLED with silicon based backplanes is being integrated into next gen display solutions like AR/VR devices, head mounted displays and microdisplays.

This growth is driven by the need for compact, energy efficient, high brightness displays in industries from entertainment and defense to healthcare and automotive. As the leading tech companies are pushing the boundaries of innovation the OLEDoS market is entering a phase of rapid evolution – driven by advancements in fabrication techniques, material science and system on chip integration. The promise of lighter, thinner and more responsive displays makes OLEDoS a foundation technology for the future of immersive experiences.

OLEDoS has several advantages over traditional display technologies – faster refresh rates, higher contrast ratios and higher pixel density – all in a smaller footprint. These are critical in applications where space is limited, energy consumption and visual clarity is paramount. As the global ecosystem of smart wearables and AR/VR grows the demand for OLEDoS displays is expected to grow significantly and set the stage for big market growth in the coming decade.

Key Market Trends Driving Product Adoption

Several major trends are accelerating the adoption of OLEDoS technologies:

- AR/VR Applications: The proliferation of AR/VR devices across entertainment, enterprise training, education and healthcare has increased the interest in micro-OLED displays. OLEDoS excels in providing compact high resolution visuals which is essential for creating virtual environments. As the tech giants like Apple, Meta and Sony are investing in spatial computing OLEDoS display is emerging as the display technology of choice in this space.

- Miniaturization and Wearable Technology: The trend towards smaller, lighter and more integrated electronics is creating new opportunities for OLEDoS. Its compatibility with CMOS silicon backplanes enables seamless integration into wearable headsets, smart glasses and heads up displays (HUDs). This trend of miniaturization without sacrificing display quality is putting OLEDoS in the spotlight.

- Advancements in Display Performance: Recent advancements in OLED materials and silicon integration have improved OLEDoS performance in terms of brightness, color gamut and power efficiency. This makes the technology more suitable for demanding applications like military targeting systems, aerospace helmets and medical imaging displays.

- Growing Adoption in Industrial and Defense Sectors: Beyond consumer markets OLEDoS is gaining traction in mission critical environments. Defense and industrial sectors need compact high precision displays that work in extreme conditions. The ruggedness and visual clarity of OLEDoS makes it the perfect choice for these applications.

Major Players and their Competitive Positioning

The OLEDoS market is getting more competitive as both established companies and specialized display makers invest in next-gen microdisplay technologies. Major players in the space are: Sony Corporation, Kopin Corporation, eMagin Corporation, BOE Technology Group, Olightek, Seeya Technology, JBD (Jade Bird Display), Panasonic Holdings Corporation, and INT Tech.

Sony is leading the way due to their early innovation and strategic application of OLEDoS in camera viewfinders and AR devices. eMagin and Kopin are focusing on expanding their presence in military, industrial and medical display markets. Asian companies like BOE and Seeya are ramping up production capacity and investing in R&D to meet domestic and global demand.

Collaborations with system integrators, OEMs and government defense agencies are common among these companies to secure long term contracts and establish technological leadership in emerging applications.

Consumer Behavior Analysis

Consumer behavior in the OLEDoS market is driven by functionality, performance expectations and application specific needs:

- High-Resolution Visual Experiences: Modern consumers want better visual fidelity across devices. Whether it’s gaming, virtual conferencing or training simulations, end users are prioritizing clarity and realism. OLEDoS displays deliver that by providing vivid imagery and wide dynamic range in compact modules.

- Energy Efficiency and Comfort in Wearables: Battery life and comfort are key for wearables. Consumers are favoring devices that are light, energy efficient and can last long. OLEDoS displays meet that with low power consumption and compact design.

- Rapid Adoption in Tech-Savvy Demographics: Young, tech fluent consumers are driving the early adoption of OLEDoS powered AR/VR headsets and smart glasses. These users are more open to new technologies especially in gaming, social media and remote collaboration.

- Professional and Industrial Demand: Professionals in healthcare, aviation and military sectors need head mounted or portable displays that can deliver high contrast, lag free visuals in real time. OLEDoS is gaining traction among these users due to its precision and responsiveness.

Pricing Trends

The cost of OLEDoS components vary depending on resolution, panel size, production yield and customization level. High end OLEDoS microdisplays are expensive due to complex fabrication process involving OLED deposition on silicon wafers. But several factors are driving down unit cost.

- Improved Manufacturing Efficiencies: Scaling up production through larger wafers (e.g. 8 inch wafers), yield optimization and new deposition techniques is reducing cost per unit.

- Vertical Integration: Leading companies are investing in in-house component fabrication which reduces dependency on third party suppliers and drives economies of scale.

- Increased Competition: More companies are entering the market and pricing is getting intense especially in consumer applications like AR/VR where cost sensitivity is high.

Despite the current premium pricing, the long term cost outlook for OLEDoS is good especially with the growth of mass market wearables.

Growth Factors

Several key elements are fueling the growth of the OLEDoS market:

- Integration with Next-Gen Wearables: OLEDoS in emerging devices like mixed-reality headsets, smart contact lenses and HUDs is a growth engine. These applications require compact, high-res, low-power displays – OLEDoS outperforms LCDs and standard OLEDs in this area.

- R&D in Advanced Materials: Research into OLED emitters, thin-film encapsulation and silicon backplane is resulting in higher brightness, better color accuracy and longer lifespan.

- Global Expansion of AR/VR Platforms: Tech platforms like Meta’s Reality Labs, Apple Vision Pro and Microsoft HoloLens are investing heavily in AR/VR. These investments are not only increasing demand but also driving innovation in display tech with OLEDoS at the forefront.

- Supportive Ecosystem Development: Software toolkits, optical engines and integration modules are simplifying OLEDoS adoption for device OEMs. This plug-and-play ecosystem accelerates time-to-market for new applications and market penetration.

Regulatory Landscape

While the OLEDoS market is tech-driven, it also has to navigate specific regulatory considerations depending on the application:

- Consumer Electronics: Displays in consumer devices need to comply with eye-safety standards, EMI limits and RoHS/REACH for hazardous substances.

- Military and Aerospace: OLEDoS modules in defense applications need to go through strict performance validation under MIL-STD conditions (e.g. temperature extremes, vibration, radiation).

- Medical Applications: Devices with OLEDoS for surgical visualization or diagnostic imaging need to meet FDA or CE requirements for medical-grade components, including biocompatibility and precision certification.

Regulatory clarity in these domains will further facilitate adoption and innovation.

Recent Developments

- Apple’s Entry into the Market: Apple’s Vision Pro headset with dual OLEDoS display and ultra-high resolution has put the technology in the spotlight. This flagship product has changed market perception and supply chain dynamics.

- Breakthroughs in Display Brightness: Recent demos from JBD and eMagin have pushed the brightness of OLEDoS microdisplays to over 10,000 nits, making them suitable for outdoor use and transparent AR systems.

- M&A and Investments: eMagin was acquired by Samsung Display, a sign of major panel makers getting interested in OLEDoS. This will accelerate R&D and capacity expansion in the near term.

- Asia-Pacific Expansion: Chinese display makers are investing in OLEDoS fabs, backed by national policies for next-gen semiconductor development. This will impact global supply.

Current and Potential Growth Implications

A. Demand-Supply Analysis: OLEDoS display demand is outpacing supply, especially for high-end applications like AR/VR. Limited capacity, high defect rate and special materials are the current supply constraint. New fabs and yield improvements will close the gap in 3-5 years.

B. Gap Analysis: There is a noticeable gap between high-end and affordable OLEDoS solutions. Current offerings cater primarily to premium or industrial applications, leaving a void in entry-level and mid-range devices. Companies that can bridge this gap with scalable, cost-effective solutions will unlock vast new markets.

Top Companies in the OLEDoS Market

- Sony Corporation

- eMagin Corporation

- Kopin Corporation

- BOE Technology Group

- Seeya Technology

- Olightek

- Jade Bird Display (JBD)

- Panasonic Holdings Corporation

- INT Tech

- AU Optronics

OLEDoS Market: Report Snapshot

Segmentation | Details |

By Product Type | Microdisplays, Full-Color Displays, Monochrome Displays |

By Application | Augmented Reality, Virtual Reality, Medical Imaging, Defense Systems, Industrial Wearables |

By End-User | Consumer Electronics, Healthcare, Military & Defense, Industrial, Automotive |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Augmented Reality (AR): The AR segment is forecasted to be the most lucrative, driven by applications in consumer wearables, enterprise productivity, and smart navigation systems.

- Medical Imaging and Visualization: The precision and clarity of OLEDoS displays make them highly suitable for surgical guidance, endoscopy, and head-mounted visualization tools in operating rooms.

Major Innovations

- High-Resolution Full-Color Panels: Breakthroughs in pixel density and subpixel architecture have enabled microdisplays with resolutions exceeding 3000 PPI, critical for AR/VR.

- Hybrid Optics Integration: OLEDoS modules are being combined with waveguides, freeform lenses, and holographic elements to create next-gen see-through AR displays.

Potential Growth Opportunities

- Expansion in Automotive HUDs: As vehicles evolve into intelligent, immersive environments, HUDs using OLEDoS will offer critical navigation and safety information directly within the driver’s field of view.

- Education and Remote Collaboration: Enhanced microdisplays in headsets will improve remote learning, industrial training, and design collaboration—areas where high-resolution visual content is crucial.

- Emerging Market Penetration: Developing regions with rising middle classes and expanding tech infrastructure present substantial growth potential for mid-cost AR/VR devices powered by OLEDoS.

Extrapolate Research says:

The OLEDoS market is set to experience exponential growth, propelled by its vital role in enabling the next generation of compact, high-performance displays. As AR/VR adoption accelerates and wearable technology becomes mainstream, OLEDoS stands out as a game-changing innovation. Its superior image quality, energy efficiency, and scalability across sectors—from consumer electronics to defense—make it a critical component in tomorrow’s immersive systems. With global investments in R&D, manufacturing expansion, and strategic partnerships on the rise, the market is poised for robust expansion.

Companies that invest early in this technology, build flexible supply chains, and align with evolving use cases will be best positioned to capture significant value. Kings Research believes that OLEDoS will not only redefine visual display standards but will also serve as a cornerstone technology for immersive digital ecosystems in the decade ahead.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

OLEDoS Market Size

- July-2025

- ���1���4���0

- Global

- Semiconductor-Electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020