Satellite Data Services Market Size, Share, Growth & Industry Analysis, By Service Type (Data Analytics, Image Data, Geospatial Mapping, Monitoring Services), By End-User (Government & Defense, Agriculture, Energy & Utilities, Forestry, Environmental, Maritime, Insurance, Others), By Frequency (Real-Time Data, Archived Data), By Data Type (Optical Data, Radar Data (SAR), LiDAR), and Regional Analysis, 2024-2031

Satellite Data Services Market: Global Share and Growth Trajectory

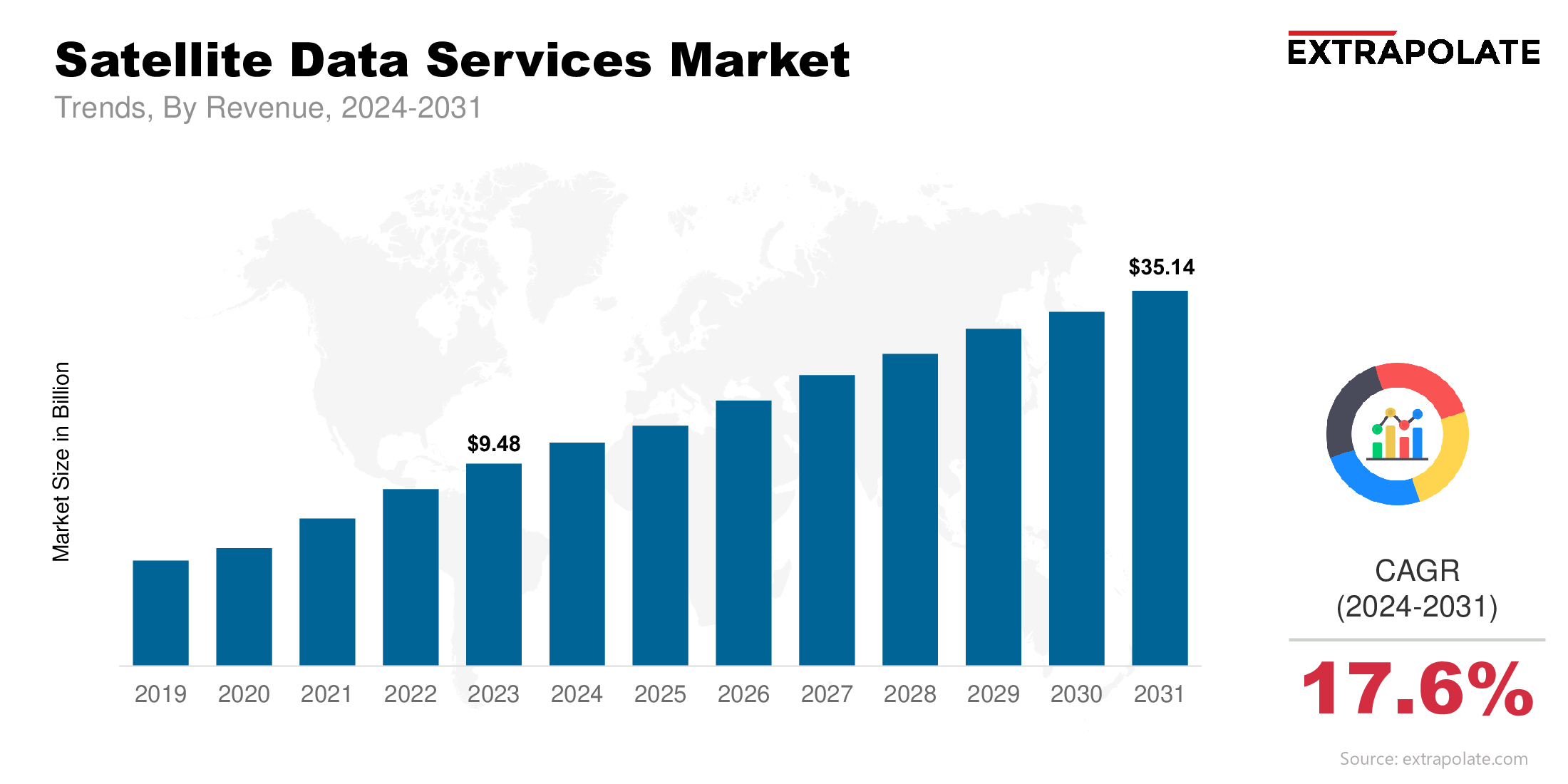

The global satellite data services market size was valued at USD 9.48 billion in 2023 and is projected to grow from USD 11.25 billion in 2024 to USD 35.14 billion by 2031, exhibiting a CAGR of 17.6% during the forecast period.

The market is growing as geospatial intelligence applications grow and industries rely more on Earth observation data. Satellite data services provide insights into environmental monitoring, urban planning, disaster response, defence, agriculture and more. These services offer high resolution imagery, synthetic aperture radar (SAR) data and real-time geospatial information to inform decision making.

A big driver of this market is the increasing number of satellites being launched into orbit by public and private players. From traditional aerospace giants to new commercial ventures more entities are providing cost effective satellite based solutions. As these constellations grow so does the access to real-time and historical satellite data. Advances in data analytics, cloud computing and machine learning are making it possible to process, interpret and use satellite data in new and innovative ways.

Satellite data is becoming essential for government agencies, private companies and non-governmental organisations. The growth of high throughput satellites, miniaturised CubeSats and improved ground station infrastructure is making satellite data services more accessible and scalable. As industries move towards smarter, more sustainable operations satellite data services will play a key role in shaping policy, strategy and performance across global sectors.

Key Market Trends Driving Adoption

- Geospatial Intelligence

Geospatial intelligence is the biggest driver of the market. Governments and commercial entities are using satellite imagery and data analytics to gain situational awareness, monitor infrastructure and track environmental changes. In defence, urban development, insurance and logistics satellite data provides strategic insights to inform decision making. As the need for precise and timely geospatial data increases satellite data services are becoming business as usual.

- Climate Monitoring and Environmental Surveillance

Environmental and climate monitoring is one of the most critical applications of satellite data. Satellites can detect changes in land use, sea levels, forest cover and atmospheric composition. Agencies like NASA, ESA and ISRO rely heavily on satellite data to track greenhouse gas emissions, monitor glaciers and predict extreme weather events. As climate change becomes more pronounced the demand for timely and accurate satellite data will grow exponentially.

- Agriculture and Natural Resource Management

Precision agriculture is emerging as a key trend with satellite data enabling farmers to monitor crop health, optimise irrigation and forecast yields. This increases productivity and sustainable farming. Similarly forestry management, water resource planning and mineral exploration benefit from the synoptic and temporal views provided by satellite imagery. This trend is driving demand for satellite data services in agriculture and natural resource sectors.

- Commercial Space Activities

The democratisation of space and the rise of NewSpace companies is disrupting the traditional satellite data landscape. Commercial companies like Planet Labs, Maxar Technologies and ICEYE are launching fleets of small agile satellites that offer high frequency and cost effective data acquisition. These players are lowering the barriers to entry and creating competitive pricing models further accelerating the adoption of satellite data services.

Major Players and their Competitive Positioning

The satellite data services industry is highly dynamic, with both established players and innovative startups competing for market share. Leading organizations in the sector include are Maxar Technologies, Airbus Defence and Space, Planet Labs PBC, L3Harris Technologies, BlackSky Technology Inc., ICEYE, Capella Space, Satellogic, Earth-i, Spire Global and others.

These companies offer a mix of high-resolution optical and radar satellite data, analytics platforms, and cloud-based services. Competitive strategies include vertical integration, strategic partnerships, acquisitions, and the deployment of new satellite constellations. Additionally, firms are increasingly embedding AI and machine learning into their service offerings to automate data interpretation and enhance actionable insights for clients.

Consumer Behavior Analysis

- Real-Time Data and Decision Support

Organizations need real-time, high frequency data to monitor fast moving events. This is especially true in sectors like defense, disaster management and agriculture where real-time insights can prevent loss and optimize outcomes. Satellite data providers are responding by launching low latency services that update within hours or minutes.

- Cloud-Based and On-Demand Services

The market is moving from traditional data acquisition models to on-demand, cloud based access. Consumers are favoring subscription based platforms that provide tailored datasets, API access and integrated analytics tools. This is reducing the complexity of using satellite data and making it more usable for non specialist users.

- Cost-Efficiency and ROI

Cost is a big consideration for customers. While raw satellite imagery can be expensive, bundled analytics solutions are proving cost effective in delivering value. Clients are looking for platforms that provide actionable insights rather than raw data, streamlining operations and increasing ROI.

- Growing Awareness and Accessibility

As more industries recognize the value of satellite data, awareness and demand is increasing. Training programs, industry conferences and educational outreach are helping bridge the knowledge gap, empowering more users – from local governments to small scale farmers – to integrate satellite data into their workflows.

Pricing Trends

Pricing in the satellite data services market is driven by factors like data resolution, revisit frequency, geographic coverage and value added services. High resolution and high revisit satellite imagery is more expensive, while lower resolution or archived data is generally cheaper. Companies are also adopting flexible pricing models:

- Pay-per-use: Clients pay based on specific data requirements.

- Subscription-based: Users get access to a certain volume of data or analytics tools monthly.

- Freemium models: Basic data access is free, premium features incur charges.

As competition increases and more satellites come online, prices are decreasing, especially for optical imagery. The growing availability of open source satellite data (e.g. from Sentinel and Landsat missions) is also putting downward pressure on pricing.

Growth Factors

- Proliferation of Small Satellites: Small satellites are changing the game. CubeSats and nanosatellites are cheap and can collect high frequency data. They’re perfect for real time monitoring and support many applications in agriculture, security and environment.

- AI and Big Data Analytics: Modern satellite data services are using advanced analytics powered by AI and big data. This means automatic pattern recognition, anomaly detection and predictive modeling. As computing power increases, the value of satellite data grows and it becomes more integral to your business.

- Government Initiatives and Public Funding: Governments around the world are investing heavily in satellite infrastructure and data services. Programs like the European Union’s Copernicus, NASA’s Earth Science Division and India’s National Remote Sensing Centre are making satellite data more available and accessible. These investments are driving innovation and adoption.

- Environmental and Security Monitoring: Whether it’s assessing damage after a natural disaster, monitoring illegal deforestation or securing borders, satellite data services offer unparalleled reach and timeliness. As threats get more complex and frequent, satellite data becomes a key tool in planning and response.

Regulatory Landscape

The satellite data services industry is governed by regulations around data privacy, national security and international space laws. Some key regulatory elements are:

- Licensing and Export Controls: In the U.S., commercial satellite operators must comply with National Oceanic and Atmospheric Administration (NOAA) licensing and International Traffic in Arms Regulations (ITAR).

- Remote Sensing Laws: Many countries including France, China and India regulate the resolution of imagery that can be commercially distributed to protect national interests.

- Data Protection and Privacy: As geospatial data gets more granular, countries are introducing stricter guidelines to ensure user and territorial privacy.

Regulatory clarity is improving in many regions, enabling growth while maintaining oversight. Governments are also offering incentives and easing restrictions to encourage private participation in space and satellite services.

Recent Developments

- High-Resolution Constellations: Planet Labs and Maxar are launching new high-res imaging satellites to increase revisit rates and data quality.

- AI-driven Analytics: Descartes Labs and Orbital Insight are combining satellite imagery with AI for predictive analytics and pattern recognition.

- Partnerships: BlackSky partnered with Palantir for real-time geospatial intelligence and Spire Global expanded into weather forecasting and maritime tracking with satellite data.

- Sustainability Monitoring: Satellite data is being integrated into ESG platforms to track sustainability metrics across industries like mining, forestry and construction.

These developments highlight how the satellite data services market is innovating rapidly to serve an expanding range of use cases and clients.

Current and Potential Growth Implications

a. Demand-Supply Analysis

As demand for satellite data increases, especially for real-time, supply is keeping up with LEO constellations and ground station networks. But there are still bottlenecks in data latency and platform interoperability.

b. Gap Analysis

There’s a big gap in affordable, user-friendly platforms that non-techies can use. And in emerging markets, satellite data adoption is hindered by infrastructure and lack of local service providers. Filling these gaps is an opportunity for players to expand.

Top Companies in the Satellite Data Services Market

- Maxar Technologies

- Airbus Defence and Space

- Planet Labs

- L3Harris Technologies

- BlackSky Technology Inc.

- ICEYE

- Spire Global

- Capella Space

- Satellogic

- Earth-i

Satellite Data Services Market: Report Snapshot

Segmentation | Details |

By Service Type | Data Analytics, Image Data, Geospatial Mapping, Monitoring Services |

By End-User | Government & Defense, Agriculture, Energy & Utilities, Forestry, Environmental, Maritime, Insurance, Others |

By Frequency | Real-Time Data, Archived Data |

By Data Type | Optical Data, Radar Data (SAR), LiDAR |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Data Analytics Services: More demand for tools that turn satellite images into insights.

- Agriculture: Precision farming and crop health monitoring driving near real-time satellite imagery.

- Environmental Monitoring: Governments and NGOs using satellite data for deforestation tracking, glacier retreat analysis and disaster impact assessment.

Major Innovations

- Real-Time Change Detection: Algorithms can now detect land-use changes and infrastructure development in minutes.

- Synthetic Aperture Radar (SAR) for All-Weather Imaging: SAR capabilities enhanced to monitor continuously regardless of weather or lighting.

- Integration with IoT: Satellite data paired with ground-based IoT sensors for enriched data sets and predictive analysis.

Potential Growth Opportunities

- Emerging Markets: Africa, Southeast Asia and Latin America investing in satellite applications for disaster management and urban planning.

- Commercial Integration with Autonomous Systems: Drones and autonomous vehicles using satellite data for navigation, environmental awareness and fleet optimisation.

- Data Marketplaces: Cloud-based data marketplaces for users to buy, sell and customise satellite data, expanding the commercial landscape.

Kings Research says:

The satellite data services market will grow exponentially over the forecast period as commercial satellite operators proliferate, launch costs decline and the need for real-time geospatial intelligence increases. As industries across the board integrate satellite data into their operations, demand will continue to rise. With AI, edge computing and remote sensing advancing, satellite data services will be the backbone of global digital infrastructure.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Satellite Data Services Market Size

- June-2025

- 140

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021